|

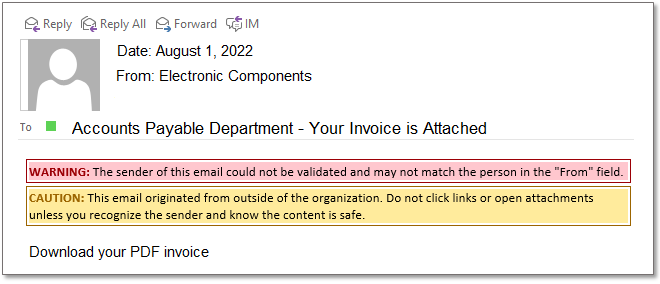

We've all seen the red highlighted message at the top of an email, "CAUTION! IF THIS EMAIL ORIGINATED OUTSIDE OF THE ORGANIZATION DO NOT CLICK ON ANY LINKS". Does your Accounts Payable Process rely on suppliers emailing invoices to your business and your AP Staff then open each email one-by-one, download a PDF or file to their computer and then print each invoice to paper. "EMAIL IS THE NUMBER ONE METHOD USED BY HACKERS TO EXPLOIT AN ORGANIZATIONS INFRASTRUCTURE, GAIN ACCESS AND STEAL INFORMATION" An AP Automation platform like, "Vision360 Enterprise", eliminates the need for AP Staff to open emails, download PDF files and print invoices. This dramatically reduces the risk of fraudulent emails exposing an organization to potential hacking or phishing schemes. In addition, this is an incredible time saver by reducing the amount of time and energy it takes an AP Department to open and print emails. An AP Automation platform like "Vision360 Enterprise" will apply a series of business rules and validations against the incoming invoices to further ensure that they are being submitted from "legitimate vendors". By having centralized processing coupled with consistent internal controls that are applied systematically and not relying on human intervention the risk of potential fraud is greatly reduced. What are computer hackers? Computer hackers are people who break into internet-connected devices such as computers, tablets and smartphones, usually with the intent to steal, change or delete information. Just as other thieves have malicious intent, hackers usually find their way into devices for negative purposes. (However, one exception is so-called white hat hackers, whom companies hire to break into their devices to find security flaws that need to be fixed.) Hackers may want to steal, alter or delete information in your devices, and they often do so by installing malware (software used for malicious purposes) you might not even know is there. These thieves might get access to your most precious data before you’re aware of a break-in. Types of hacking: Ransomware is on the rise! Here are some of the reasons computer hackers break into devices:

Accounts Payable Automation systems can modernize your invoice processing by reducing risk, providing cost control and increasing efficiencies. Please consider registering for one or our informational webinars or contact us directly for more information.

0 Comments

You advertise for an open AP Specialist position. The ad reads something like this: Description Our team is seeking an Accounts Payable (AP) Specialist who will be responsible for processing (i.e., coding and entering) and paying vendor invoices and employee expenses in a timely manner. Essential Functions

You seek a candidate with relevant job experience, skilled in accounting practices, they will be involved in the cash flow for your business, the need to make quick business decisions that effect your supply chain and vendor relationships. However, with all this in mind, they will spend between 40 - 60 percent (or more) of their day manual keying invoices into the financial system for payment processing. Seems like all this experience could be used to better serve the business and their interest in a career in accounting. You went through the process of advertising (costs money), interviewing candidates (costs time & money), hiring and training the new hire (costs time and money) and in the end they spend more time keying invoices than any other function. Does manual invoice keying make the best use of your AP Staff's time?

Your organization is growing, you had someone leave the accounts payable department or you simply want to be able to promote from within. Either way you have a position open for an FTE in accounts payable. So what do you do? Wages are on the rise, specialized accounts payable skill sets are rare, and the high cost of traditional recruiting can put a big freeze on hiring efforts. An organization may need to expand operations, but they may lack the resources and human capital to do so. So what does a business do? Many organizations are turning to accounts payable processing systems like workflow and invoice automation rather than going through the exercise of advertising, recruiting, interviewing and sifting through hundreds or possibly thousands of applications only to find that the talent pool is limited in this area. With an accounts payable workflow and invoice automation system the tedious, time-consuming tasks associated with manually processing accounts payable invoices are completely eliminated. These tasks usually include the following:

The above scenario obviously varies company by company and person to person. Some people are faster and some people are slower. Some vendors invoices are easier than others. The most important thing to keep in mind is that these are non-essential tasks that can be handled by an accounts payable invoice processing system. An accounts payable invoice processing system will be working non-stop for you. The system doesn't take breaks and never leaves the building. The system doesn't need time off, or benefits or extra's and it will always go the extra-mile for you whether you want it to or not. You may want to consider an accounts payable invoice processing system before you write that next job posting. You may find that the descriptions are very similar. You may also find that the cost for an accounts payable invoice processing system like "Vision360 Enterprise" is less than the loaded cost of an FTE. Contact us directly for more information or consider attending one of our informational webinars.

From payroll to accounts payable (AP), B2B payments fraud continues to threaten organizations of all sizes, industries and geographies.

It’s a risk to which no one is immune, even billionaire investor Mark Cuban, who recently spoke with reporters at CNBC about his own experience dealing with a nasty case of AP fraud. Nearly $13 million was defrauded out of two finance companies over nearly six years by MyPayrollHR, admitted the payroll company’s CEO, Michael Mann, who pleaded guilty to a charge of conspiracy to commit wire fraud, reports in the Times Union said. Mann admitted to conspiring to fraudulently secure loans worth millions of dollars for Mann’s own companies. To do so, he reportedly represented false invoices allegedly owed to those companies in the form of accounts receivable. Reports noted, however, he has not entered a plea in response to charges of bank fraud. $82,000 was stolen from Cuban’s first company via AP fraud, the entrepreneur told CNBC. He reflected on the experience that occurred at his first company, MicroSolutions, when he was only 24 years old. “I’m like, ‘OK, for our accounts payable, we print out the checks to the vendor,’” he recalled, adding that those checks were then given to a receptionist to pay suppliers. Yet that receptionist forged those checks to pay herself, leaving just $2,000 left in the company’s bank account — a scenario Cuban ultimately said helped him get more serious about his business ventures. More than $300,000 was embezzled from a California company through its corporate card, reports in VC Star said. An internal audit of the Simi Valley business found one employee recently promoted had been misusing the company’s commercial card to make unauthorized purchases, while that individual is also accused of manipulating the firm’s payroll system to overpay herself. That employee has been arrested, reports said. $740,000 was stolen from a Washington county via phishing attack, local Tri-City Herald reports said. An email posing as a legitimate construction vendor for Benton County requested an invoice payment, and a government employee fell for the scam that had convinced the employee to change the payment details for that particular vendor. Authorities were able to recover a majority of the funds. The case coincided with separate reports in The Durango Herald of a similar scam targeting county officials in New Mexico, which led to $447,000 stolen from Bernalillo County. $4.5 million was embezzled from an Oregon company over a decade by a woman accused of submitting fraudulent invoices for a fake vendor. According to KEZI reports, that employee would then generate checks in AP to pay that false vendor, wielding her position in the company’s accounting and finance departments to then direct those payments to her personal account. The employee reportedly admitted to mail fraud, aggravated identity theft and tax evasion. A $168.7 million invoice fraud ring was busted by Indian officials, the Hindustan Times reported recently. Three men were arrested under new Goods and Services Tax (GST) regulations following an investigation, which reportedly discovered the men allegedly falsifying invoices and companies in order to steal funds from iron and steel manufacturers. In this week’s B2B Data Digest, PYMNTS uncovers the latest stories in B2B payments fraud from Cuban and others, including a busted invoice fraud ring in India, plus the latest on the ongoing MyPayrollHR fraud saga. Reprint Credit: PYMNTS PYMNTS is reinventing the way companies share relevant information about current developments in the connected economy space. Our powerful B2B platform is the #1 site in the U.S. and globally by traffic and the premier source of news and analysis for the industry. Today's CFO faces never ending pressures to grow revenues, ensure financial controls and reduce operational costs across the enterprise. This is no easy task for any CFO, who has to deal with things like economic uncertainty, increased regulatory requirements and increased scrutiny from investors. CFO's have a few diverse and challenging roles, Steward, Operator, Strategist and Catalyst. The traditional role require CFO's to preserve the assets of the organization by minimizing risk and getting the books right and running a tight finance operation that is efficient and effective. It's increasingly important for CFO's to be strategists, helping to shape the overall strategy and direction, instilling a financial approach and mindset throughout the organization to help all parts of the business to perform at a high level. As Strategist, CFO's help influence the future direction of the company by taking a seat at the strategy planning table. CFO's are vital in providing financial leadership and aligning business needs and financial strategies to grow the business. As Catalyst, CFO's can drive the execution of change within an organization. CFO's are in a position that allows them to drive business improvement initiatives such as enterprise process improvements, cost reductions, and innovations that add value to the business and affect the bottomline. As Operator, CFO's have to operate an effective and efficient finance team that provide many different financial functions to the organization such as treasury, tax, sales, planning, analysis, accounts receivable and accounts payable. As Steward, CFO's work to protect the vital assets of the company, ensure compliance with financial regulations, close the books accurately and communicate value and risks to investors and boards. With all of the challenges faced by today's CFO how can Accounts Payable Automation help? By leveraging current AP Automation technologies, finance departments operate at a much higher efficiency level, with lower overall operational costs than those finance teams relying on manual processes. The CFO can now be assured that financial rules, policies and procedures are being enforced by the AP Automation technology. This ensures that proper protections are in place, segregation of duties are enforced and compliance requirements are met. Since today's AP Automation solutions provide an extremely high-level of efficiency gains, finance departments are no longer burdened by time-consuming, error-prone, manual tasks and can now focus on financial tasks that will help CFO's to manage cash flow, monitor liabilities and make more effective business decision regarding the future growth and bottomline of the company. Vision360 Enterprise, by BlueCreek Software is one of the fastest growing AP Automation solution providers on the market. Our services and solutions are trusted by iconic brands like Welch’s and Yankee Candle and across all types of industries from manufacturing and retail to healthcare and high-tech. For more information about Vision360 Enterprise or any of our services and solutions please visit our website at www.Vision360Enterprise.com or contact us directly 603-437-1400.

If you've been utilizing an AP Automation system for 3 years or more chances are your system has not kept pace with the needs of your AP department. Your AP Automation system probably has not kept up with the latest technologies in speed and performance, or business process efficiencies gains and compliance requirements. Many AP departments using older AP Automation system admit that there are limitations to these systems and that there is still a fair number of manual steps and intervention required by AP Staff to accurately process supplier invoices. Not to mention:

Does this sound like you? Vision360 Enterprise AP Automation accomplishes all of the above and much, much more. Organizations like Welch's, Yankee Candle, Harrington Healthcare, Ames Tools, MKS Instruments, King & Prince Seafood and many, many more are realizing incredible efficiency gains and savings utilizing Vision360 Enterprise AP Automation for processing their supplier invoices.  Answer a few questions and get a quote. It's that simple! The process of evaluating accounts payable automation solutions can be a daunting and very confusing task with all the options and possibilities. Let's face it, accounts payable automation is not a new concept and has been around for years now. Once upon a time this type of solution was for the big boys, but today companies of all shapes and sizes can realize a significant benefit and reduction in accounts payable. If you're interested in the cost of accounts payable automation to decide if this is even doable for your organization or need a quote to satisfy your purchasing requirements then consider using our "SELF-SERVICE" quoting system.  With all Finance has to get done in a given day sometimes it’s hard to find the time to step back and track how efficient and effectively your department is running. Finance deals in numbers all day. But how often are you generating numbers to find out how efficient your finance team is? But benchmarking is more critical than ever. By monitoring your functions’ performance you can determine where you can streamline, boost efficiency (and possibly cash flow) and incentivize staffers to do an even better job. So what are the best metrics out there? Here are a few to get you started. How many of them are you currently using … and how many more could you be? Accounts Payable

Accounts Receivable

Payroll

The last thing you want is for people to think you’re trying to “catch them” doing something wrong in their jobs. Better to position metrics as a way to raise the bar and a springboard to figure out what needs to most attention. Please share any additional metrics you are using today! Not Going Paperless? Here Are Some Tips Then To Make Life A Little Easier In Accounts Payable.3/9/2015  Let's face it, processing supplier invoices can be a daunting task, and, in some cases, a smaller accounts payable department can feel the "invoice processing pain" simply due to a lack of resources more so than larger companies who may be drowning in sheer volume of invoices. Either way the steps of processing, routing, matching, approving, coding, entering and paying invoices is error-prone, labor intensive and in-efficient. So what do you do if upper management isn't onboard with accounts payable process improvements or invoice automation? Here are a few ways that being organized and following standard processes can help. 1. Don't pay from invoice copies. This can lead to duplicate AP transactions and payments. If you have to pay from a copy, be sure to check your records for the same invoice number and dollar amount. 2. Make sure you have a W-9 on file BEFORE paying a vendor. This will save a lot of hassle at year-end when you need to prepare 1099s. Fines for not complying with 1099 reporting can be hefty and the rules change from time to time. 3. Have rules about how invoice numbers are formatted and entered. If accounts payable team members are all using their own rules about entering invoice numbers (like what to do with leading zeros), it will be difficult to track down anything. Also, make sure you have a policy for invoices that don't have invoice numbers on them. 4. Segregation of duties! The person entering the invoice should be different from the person approving the invoice who should be different from the person signing the check. 5. Centralized receipt of supplier invoices. Okay, so this is easier said than done however, having all invoices come to the accounting department first before being sent out for approval(s). This way the invoice can be logged before it enters the black hole. 6. Enter invoices one at a time. Do not enter invoices as a batch. Each one should be entered individually in order to have an audit trail. 7. Coding of invoices. All invoices should have the G/L account coding written on them as well as any notes about special handling. 8. The amount of the invoice should be entered as billed even if you don’t plan on paying the full amount. A credit memo can be entered and matched against the invoice later. The key is to remember the audit trail. 9. Have a new vendor welcome letter that you can send informing them of where invoices should be sent, what information you require to process their invoices (like a vendor ID number) and any forms you need completed. Vendors will appreciate the information to ensure their payments aren’t held up. 10. Watch your payables carefully to take advantage of any discounts being offered by vendors. It can add up to a nice sum by the end of the year. 11. Setup your vendor files alphabetically and file your paid invoice as soon as completed. There are many more ways to ensure a smooth accounts payable process if upper management won't go for process improvement. Feel free to list your own ideas that may help others looking for ways to make their accounts payable process better.  We all know how important it is to keep customers happy. Don’t meet their needs or make them mad and they may leave you. Even worse, their comments may cause others to leave with them. Just like customers, you also need to keep vendors happy. If you don’t you may find your credit line cutoff and that you cannot get essential products and services. Imagine what happens when you cannot get the product you need to sell or use in your manufacturing process. Pretty soon it impacts your company’s ability to satisfy customers. The accounts payable days analysis is a statistic you can calculate that indicates how good of a job you are doing managing accounts payable and keeping your vendors happy. Days payable outstanding (DPO), defined also as days purchase outstanding, indicates how many days on average a company pay off its accounts payable during an accounting period. Days payable outstanding means the activity ratio that measures how well a business is managing its accounts payable. The lower the ratio, the quicker the business pays its liabilities. It also shows the average payment terms granted to a company by its suppliers. The higher the ratio, the better credit terms a company gets from its suppliers. From a company’s prospective, an increase in DPO is an improvement and a decrease is of course, "not good for business and cash flow". Value is a two-way street. Of course, vendors want to provide their clients with the best possible return on their investment. But they're a business, too. If a client makes a project difficult to staff, hard to schedule and costly to execute, more likely than not it will affect the initiative's outcome and value negatively. On the flip side, though, there are clients, even very large ones, that help vendors get through their internal processes, bureaucracy and political hurdles. Clients that smooth the way for vendor teams internally are going to get a superior value from their investment in our services. Effort will be spent on the work the vendor was hired to do, not on jumping through hoops. The vendor staffs up, their people get to work and they are able to focus – which always results in better quality and value at the end of the day. Once negotiations are closed, vendors want to shift their focus from winning the business to meeting the goals and expectations of their client. Yet they sometimes encounter major delays, bureaucratic hurdles and work stoppages based on internal processes and politics. This only hurts the client's project, yet it is often caused by the client organization's own internal structure and approach to management. So. Look at your vendor management processes. Would you want to work with you? Are you making your vendors happy? Do they have a fast-track, once you've signed with them? Or do they have to navigate a complex system of approvals and oversight? Are your schedules in alignment with theirs? Do your internal teams understand what's going on, who's involved and what the goals are? How many levels of management do they encounter? Do they have a point-of-contact with authority? Vendors usually expect to navigate these processes with every client. Even giant companies with hugely complex internal systems and challenging politics can get great value from their vendors by providing them with the tools and management resources they need from the start. As businesses invest millions into their technologies, and vendors do more and more of the work, any organization that engages with technology vendors on key initiatives risks a great deal by failing to be good to work with.

The benefits of integrating Vision360 Enterprise accounts payable processing with MS Dynamics:

- Seamless integration reduces the need for technical resources - Allows for rapid deployment - Accounts payable dashboard provides 100% visibility to supplier invoices - Eliminates 100% of paper invoices - Captures email invoices electronically - Eliminates the need for data entry - Powerful coding tools - Perform 2 & 3-way matching - Data validation engines ensures accuracy - Centralized processing and controls - Complete audit trail of approval activity - Generate instant efficiency reports - Instantly access invoices from electronic archive - Enforces your security, processing rules and compliance We do not take a one size fits all approach to any engagement. Our strength is in our ability to objectively evaluate the business problems and challenges that affect every day. By leveraging our business process solutions experience, coupled with our technical expertise we are able to effectively analyze and recommend a variety of viable solutions to fit the needs of any business problem and challenge we are faced with. For more information contact us or call 603-437-1400 x308  It's never been easier for employees to complete and submit expense reports. Vision360 Enterprise Expense allows staff to create electronic expense reports, attached receipts and submit to managers for review and approval. Vision360 Expense will streamline the expense reporting process and improve the review and approval flow between departments. Vision360 Expense turns lengthy, tedious paper-based approval processes into one-click approvals. Managers can easily review and approve expense reports from anywhere, at anytime – no paperwork involved. All expense reports and receipts are in one location making review and approvals faster and easier than ever. Enforcing reimbursement and expense policies and streamlining the expense process has never been easier. How Does It Work? Employees simply fill out the reimbursement form, attach their receipts and click submit! The expense report is sent directly to their manager for approval! That's all there is to it. 1. Eliminates paper from the review and approval process 2. Attaching digital receipts this keeps things organized 3. Having visibility to expense reports during the approval process cuts down on the number of status inquiries from employees 4. By using electronic expense reports employees can manage expenses from anywhere 3. Electronic expense reports can be quickly approved ensuring that employees get reimbursed promptly for their expenses SUBMIT APPROVE PAY Vision360 Expense will allow you to monitor all aspects of your business travel and reduce excessive spending. Gain visibility into your company's spending with comprehensive data, reporting and custom reports. Regardless of when a transaction occurred, what form of payment was used, or which supplier or vendor was selected, you'll get detailed analytics into your overall travel spending. Then, you can set rules to increase control, eliminate loopholes, improve spending behavior, and lower your overall expenses.

1. Invoice Processing Costs:

What's your cost to process a single supplier invoice? There are many factors that affect the cost to process a single supplier invoice. Many of these costs are attributed to the "clerical duties" performed by skilled accounting staff. These clerical duties include opening incoming mail, sorting and staging invoices into batches, sending paper invoices to approvers for proper coding and approval, performing manual data entry of key invoice data into the accounting system for payment processing. Many studies have been performed by trade associations i.e. Paystream Advisors, Aberdeen Group, The Accounts Payable Network, IOFM and many more. The statistics have shown that the average cost to process a single invoice is roughly $15 dollars and companies with significant accounts payable processing challenges have seen their costs in the range of $38.00 per invoice. Organizations that have implemented some level of accounts payable process improvement have realized a significant savings of 60-80% over manual invoice processing with per invoice costs reduced to $3 dollars or less per invoice. 2. Invoice Processing Speeds: How long does it take for your supplier invoices to process through your organization for payment? The time it takes can greatly vary depending on the number of manual steps an invoice needs to go through for proper approvals, matching, coding and entry into your accounting system. According to the "Aberdeen Group" the average processing time to process invoices manually is between 24 - 30 days, while companies that have implemented some level of accounts payable process improvement have seen their processing times reduced down to 5 days or less. 3. Productivity Per Team Member: Are your accounts payable team members equally productive? Take the number of accounts payable invoices per month and divide by the number of invoices processed. You should also factor in the tasks performed by each team member. It is estimated that 75% of the labor and time associated with processing supplier invoices is performed by the accounts payable department. Measure the time it takes to process an invoice today and you can be assured that accounts payable automation will double the throughput and significantly reduce the costs to process an invoice. 4. Variance Analysis/Correction Rates: Variances can be caused by many factors, however the time it takes to correct them can cost your company more than 10 times the costs to process a single invoice correctly! Are line items coded correctly? Are manual keying errors causing bottlenecks? Are you able to report on variances in a timely manner? With accounts payable automation rules can be put in place to correctly process invoices and flag those invoices with issues and route them for resolution and instantly report on any variance or processing issues. 5. PO Matching Process and Speeds: The process to manually match an invoice and the time it takes can vary dramatically between organizations, processes and definitely between people. Let's face it - some people are just faster than others and some accuracy vary. With accounts payable automation business processing rules can be applied to "automatically match" invoices against your purchase order, receiver, vendor master or any other criteria. When applying these "auto-matching rules" invoices can be "automatically coded" to eliminate the need for manual data entry, hence eliminating the "fat finger" problem. 6. Invoice Entry: Invoice entry largely relies on skilled accounts payable staff to take the time to enter by hand the information from a supplier invoice into the company's accounting system. As you might expect manual data entry is "error-prone" and relies on people. With accounts payable automation the data captured during the routing, matching, coding and approval of invoices is transferred into the accounting system, "error-free". With Vision360 Enterprise accounts payable departments can expect to eliminate all of the manual touch points and process associated with process, paying and maintaining supplier invoices. With Vision360 Enterprise there is nothing to purchase, no software licensing restrictions, no annual software maintenance and very little IT resources needed. Vision360 Enterprise automates the routine steps involved in approving invoices. Once supplier invoices are captured, the invoices can be routed to approvers based on business rules, through multiple levels of approvals, coded and released for payment.

Do You Feel Like Your AP Department Is Operating in the Dark?

Studies show that best-in-class companies outperform other businesses by automating their invoicing processes, and other key business processes, with document imaging and workflow stems. According to Aberdeen Research’s “businesses that automate their account payable operations reap significant advantages—including processing their invoices significantly faster and at much lower cost. For companies that fail to automate, the study found, “Paper invoices and manual processing continue to hamper accounts payable operations, keeping suppliers in the dark and failing to give accounts payable the visibility it needs to actively manage organizations’ cash positions.” Best-in-class companies, on the other hand, overcome this impediment by pursuing “comprehensive accounts payable automation to drive continued performance improvement.” The end goal is to maximize the impact of automation on all accounts payable processes, from receipt to scanning to approval workflow through payment. How well does automation improve invoicing operations? According to Aberdeen’s research, best-in-class companies outperform their peers by a considerable margin, taking 3.8 days and a cost of $3.09 to process an invoice vs. the industry average (middle 50%) of 9.7 days and $15.61 per invoice. For the bottom 30%, it takes 20.08 days at a cost of $38.77 per invoice. Respondents who implemented document imaging and workflow automation reported 21% lower invoice processing costs than others, while also securing early payment discounts on more than twice the number of transactions. Further improvements, the study found, can be gained from integration with back-end financial and ERP systems and the use of performance-monitoring dashboards. A Surge in Workflow Deployment Aberdeen Research’s findings jive with those of PayStream Advisors’ latest survey, which showed that electronic invoicing and automated workflow are both experiencing increased adoption, as more companies strive to migrate from a manual paper-based invoice system to an efficient automated system.” As PayStream Advisors notes, “Skeptics may still doubt the ROI ofautomated approval workflow, but it is getting harder to defend that position in the face of the facts.” PayStream Advisors’ study, which surveyed 500 accounts payable professionals, showed that the top three financial automation technologies that have been most useful include eInvoicing, workflow, and front-end imaging/OCR. Electronic invoicing and automated workflow are the top automation goals for accounts payable in 2013, the study showed. The number-one benefit cited for approval workflow was the quicker approval of invoices (76 percent), while one-half were able to increase employee productivity, and nearly 60% reported lower processing costs. As PayStream Advisors notes, invoice processing can be expensive and time consuming when performed using manual processes and paper documents, while electronic invoicing and automated workflow can lower costs and speed up processing. Overall, more than one-half of companies that adopted eInvoicing solutions cited a reduction in labor or processing costs and faster approval cycles as key system benefits, as well as greater visibility into spending, improved cash management, and an increased ability to capitalize on early-payment discounts. As workflow technology becomes easier to deploy and more affordable, including software-as-a-service offerings, more businesses are able to obtain the benefits. As PayStream Advisors reported, “The market for electronic invoicing and automated workflow continues to open up as adoption trickles down from large organizations to small and medium enterprises.” - See more at:

Labor-intensive manual accounting systems and paper-based invoices have been plaguing accounts payable departments for decades. Departments relying on manual systems are finding that adding staff does not solve the inherent problems of unrecorded liabilities; duplicate, inaccurate, or unauthorized payments; and misappropriated cost allocations. These departments are struggling to meet their organizations’ basic need for visible, timely, and accurate financial reporting and control. And compounding the problem, their manual systems make it difficult, if not impossible, to address the critical issues at the heart of compliance.

In a study by the Aberdeen Group, organizations reported between 40% and 60% savings by implementing the right invoice automation solution. Although results can vary based upon the package, in many cases the investment pays for itself in a matter of months. 1. Reduce costs. In these tough times, cost reduction is still on the front burner for corporate financial execs—and they are looking to their operational departments to deliver more savings. Also, they know that basic transactional processes can be done cheaply overseas. This is not a welcome thought to AP. Fortunately, this can most often be avoided by using automation. Many AP departments have slashed costs up to 75 percent and more using automation. Of course, there are many different approaches to take and many tasks and subtasks that are candidates for automation, including the entire invoice process. Overall, an end-to-end automation process can bring your per-invoice processing costs down to a few dollars. The primary way to cut costs in AP using automation is to use it to get rid of the paper invoice (or paper expense report). You can use imaging, where you scan your paper invoices and route the images for approval and payment. Along with this, you can eliminate manual data entry and input of the invoice data. On the other hand, you can avoid paper altogether by going to electronic invoicing— that is, receiving the invoice from the vendor in an electronic format that goes right into your accounting system. 2. Increase efficiency. Hand in hand with cost reduction comes increased efficiency. This is triggered because automation can create a touchless process for invoice processing. With certain electronic invoicing setups, AP doesn’t even see the invoices coming in—they are automatically received, matched to purchase orders (POs), and then paid. For non-PO invoices, the electronic bills are automatically routed to approvers. All AP sees are exceptions and any invoices that do not come through the e-invoicing process. Many AP benchmarking studies have found that efficiency levels increase as automation increases. For example, at AP departments with a low level of automation, a staffer can process about 2,000 invoices a month—but that figure doubles to about 4,000 with a high level of automation. 3. Eliminate errors. Errors in the invoicing process waste a lot of time—you have to do a lot of unproductive re-work. Every automated invoice solution on the market addresses data verification and quality assurance, either before the invoice is received or while it is in the AP department being prepared for approval. In some cases, the invoices are "pre-screened," meaning that the solution applies various tests to ensure that they are complete and accurate. For instance, they may check for a valid vendor number or PO number. And they can do a match check by cross-checking the addition of line items with the invoice total. You can also define parameters, such as minimum dollar amounts or maximum variances, for your key vendor. 4. Prevent fraud. In many ways, AP automation can help prevent fraud perpetrated either by con artists sending phony invoices or dishonest employees. As already mentioned, automated invoice solutions can check for valid vendor numbers and POs. For invoices without a PO, the systems can compare an invoice to contract pricing, terms, and so on. This provides a quantitative, automated method of ensuring an invoice is right. Using an automated system for employee travel and entertainment (T&E) reimbursements also helps prevent fraud. Detailed business rules can be embedded in T&E systems that red-flag questionable expenses. Also, some T&E systems now offer complex analytical tools that, for example, can match actual travel spending on what was booked. On the payment side, moving from paper checks to electronic payments using ACH or other method cuts down on fraud because paper checks are vulnerable to tampering. But ACH is not totally immune to fraud, so features such as debit blocks and filters should be used. 5. Capture more discounts. Because invoice automation speeds up the payment cycle time, AP managers say they have a better chance of capturing more early-payment discounts. Also, invoice technology has given rise to automated discount management capabilities that many believe will become a significant factor in the evolution and growth of invoice automation. According to IOMA’s Paperless Accounts Payable: The AP Department’s Complete Guide to Invoice Automation, customers of one solution provider are reporting that their return on investment from discounting is five to 10 times as large as their return on investment from processing cost reductions. 6. Enhance cash flow. The vast majority (80 percent) of AP pros recently polled on AccountsPayable360.com said that AP has a "high" or "somewhat high" impact on their companies’ cash flow. There are traditional, nontechnology ways to do this, such as stretching paydates and decreasing staff overtime, but automation has triggered the ability to affect cash flow to a greater degree. Already mentioned is the ability to use automation for invoice discount management, but others include controlling the timing of payments by using electronic methods, such as ACH, or by using corporate credit cards to pay invoices. Also, automation improves cycle time, which reduces the chance of paying late-payment penalties. 7. Increase visibility. Automated invoice solutions give you a transparent view of every step of the invoice-handling process. Monitoring the invoices throughout the process allows for audit trails and strict financial controls to help ensure compliance with internal corporate policies and external legal requirements, such as the Sarbanes-Oxley Act. Electronic storage also helps ensure regulatory compliance and makes document retrieval much easier, especially when customers can do their own lookups of past invoices. This also helps during audit time, when invoices need to be pulled. This visibility also saves time during the month-end close because accurate accruals can be made quickly because all of the invoices are being tracked and can be captured and reported. 8. Free up staff time. Many AP departments that have automated find that they save so much time that they can eliminate head count. But instead of doing this, they have made great efforts to redeploy the staff. For example, invoice automation can reduce the need for invoice processors, so move them onto a help desk in shared services or train them to do analysis of spending, which has many benefits, such as leveraging the ability to negotiate better contracts with vendors, identifying repetitive purchases for better sourcing opportunities, and uncovering "by-passing" (purchases made outside existing contracts). 9. Improve AP’s image. As the work in AP becomes more automated, the department has a golden opportunity to shine. When technology projects are implemented, track the results and then make sure the top brass knows about the improvements, be they quantitative (e.g., costs and efficiency) or qualitative (e.g., better customer service and improved vendor relations). Document each change and the savings, be they in time or money, and pass them along. 10. Advance your career. Use the positive results of AP automation to get the credit you deserve by making upper management aware of the results. True, most people are uncomfortable bragging about themselves, but it’s necessary to do this to some extent. Not only will it give you the credit, but it will also make implementing future changes easier if you have a positive track record.  An Accounts Payable manager from Carolina Steel Group, LLC is heading to jail after being convicted of multiple counts of wire fraud and money laundering. During her time at the steel company, Angela Womack, 51, allegedly opened personal accounts under the name ‘IBOCF’ and would create vendor cheques payable to ‘International BOCF,’ attempting to cover her tracks by including them on the company’s vendor reports... read the full story. |

AuthorVision360 Enterprise Accounts Payable Automation Solution by BlueCreek Software reduces time wasted chasing down paper invoices by automating invoice approvals, eliminating manual data entry, eliminating paper invoices and reducing processing costs. Categories

All

Archives

September 2023

|

RSS Feed

RSS Feed