|

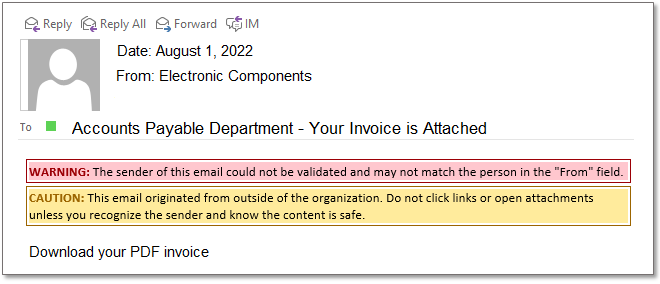

We've all seen the red highlighted message at the top of an email, "CAUTION! IF THIS EMAIL ORIGINATED OUTSIDE OF THE ORGANIZATION DO NOT CLICK ON ANY LINKS". Does your Accounts Payable Process rely on suppliers emailing invoices to your business and your AP Staff then open each email one-by-one, download a PDF or file to their computer and then print each invoice to paper. "EMAIL IS THE NUMBER ONE METHOD USED BY HACKERS TO EXPLOIT AN ORGANIZATIONS INFRASTRUCTURE, GAIN ACCESS AND STEAL INFORMATION" An AP Automation platform like, "Vision360 Enterprise", eliminates the need for AP Staff to open emails, download PDF files and print invoices. This dramatically reduces the risk of fraudulent emails exposing an organization to potential hacking or phishing schemes. In addition, this is an incredible time saver by reducing the amount of time and energy it takes an AP Department to open and print emails. An AP Automation platform like "Vision360 Enterprise" will apply a series of business rules and validations against the incoming invoices to further ensure that they are being submitted from "legitimate vendors". By having centralized processing coupled with consistent internal controls that are applied systematically and not relying on human intervention the risk of potential fraud is greatly reduced. What are computer hackers? Computer hackers are people who break into internet-connected devices such as computers, tablets and smartphones, usually with the intent to steal, change or delete information. Just as other thieves have malicious intent, hackers usually find their way into devices for negative purposes. (However, one exception is so-called white hat hackers, whom companies hire to break into their devices to find security flaws that need to be fixed.) Hackers may want to steal, alter or delete information in your devices, and they often do so by installing malware (software used for malicious purposes) you might not even know is there. These thieves might get access to your most precious data before you’re aware of a break-in. Types of hacking: Ransomware is on the rise! Here are some of the reasons computer hackers break into devices:

Accounts Payable Automation systems can modernize your invoice processing by reducing risk, providing cost control and increasing efficiencies. Please consider registering for one or our informational webinars or contact us directly for more information.

0 Comments

From payroll to accounts payable (AP), B2B payments fraud continues to threaten organizations of all sizes, industries and geographies.

It’s a risk to which no one is immune, even billionaire investor Mark Cuban, who recently spoke with reporters at CNBC about his own experience dealing with a nasty case of AP fraud. Nearly $13 million was defrauded out of two finance companies over nearly six years by MyPayrollHR, admitted the payroll company’s CEO, Michael Mann, who pleaded guilty to a charge of conspiracy to commit wire fraud, reports in the Times Union said. Mann admitted to conspiring to fraudulently secure loans worth millions of dollars for Mann’s own companies. To do so, he reportedly represented false invoices allegedly owed to those companies in the form of accounts receivable. Reports noted, however, he has not entered a plea in response to charges of bank fraud. $82,000 was stolen from Cuban’s first company via AP fraud, the entrepreneur told CNBC. He reflected on the experience that occurred at his first company, MicroSolutions, when he was only 24 years old. “I’m like, ‘OK, for our accounts payable, we print out the checks to the vendor,’” he recalled, adding that those checks were then given to a receptionist to pay suppliers. Yet that receptionist forged those checks to pay herself, leaving just $2,000 left in the company’s bank account — a scenario Cuban ultimately said helped him get more serious about his business ventures. More than $300,000 was embezzled from a California company through its corporate card, reports in VC Star said. An internal audit of the Simi Valley business found one employee recently promoted had been misusing the company’s commercial card to make unauthorized purchases, while that individual is also accused of manipulating the firm’s payroll system to overpay herself. That employee has been arrested, reports said. $740,000 was stolen from a Washington county via phishing attack, local Tri-City Herald reports said. An email posing as a legitimate construction vendor for Benton County requested an invoice payment, and a government employee fell for the scam that had convinced the employee to change the payment details for that particular vendor. Authorities were able to recover a majority of the funds. The case coincided with separate reports in The Durango Herald of a similar scam targeting county officials in New Mexico, which led to $447,000 stolen from Bernalillo County. $4.5 million was embezzled from an Oregon company over a decade by a woman accused of submitting fraudulent invoices for a fake vendor. According to KEZI reports, that employee would then generate checks in AP to pay that false vendor, wielding her position in the company’s accounting and finance departments to then direct those payments to her personal account. The employee reportedly admitted to mail fraud, aggravated identity theft and tax evasion. A $168.7 million invoice fraud ring was busted by Indian officials, the Hindustan Times reported recently. Three men were arrested under new Goods and Services Tax (GST) regulations following an investigation, which reportedly discovered the men allegedly falsifying invoices and companies in order to steal funds from iron and steel manufacturers. In this week’s B2B Data Digest, PYMNTS uncovers the latest stories in B2B payments fraud from Cuban and others, including a busted invoice fraud ring in India, plus the latest on the ongoing MyPayrollHR fraud saga. Reprint Credit: PYMNTS PYMNTS is reinventing the way companies share relevant information about current developments in the connected economy space. Our powerful B2B platform is the #1 site in the U.S. and globally by traffic and the premier source of news and analysis for the industry.  Answer a few questions and get a quote. It's that simple! The process of evaluating accounts payable automation solutions can be a daunting and very confusing task with all the options and possibilities. Let's face it, accounts payable automation is not a new concept and has been around for years now. Once upon a time this type of solution was for the big boys, but today companies of all shapes and sizes can realize a significant benefit and reduction in accounts payable. If you're interested in the cost of accounts payable automation to decide if this is even doable for your organization or need a quote to satisfy your purchasing requirements then consider using our "SELF-SERVICE" quoting system.  We all know how important it is to keep customers happy. Don’t meet their needs or make them mad and they may leave you. Even worse, their comments may cause others to leave with them. Just like customers, you also need to keep vendors happy. If you don’t you may find your credit line cutoff and that you cannot get essential products and services. Imagine what happens when you cannot get the product you need to sell or use in your manufacturing process. Pretty soon it impacts your company’s ability to satisfy customers. The accounts payable days analysis is a statistic you can calculate that indicates how good of a job you are doing managing accounts payable and keeping your vendors happy. Days payable outstanding (DPO), defined also as days purchase outstanding, indicates how many days on average a company pay off its accounts payable during an accounting period. Days payable outstanding means the activity ratio that measures how well a business is managing its accounts payable. The lower the ratio, the quicker the business pays its liabilities. It also shows the average payment terms granted to a company by its suppliers. The higher the ratio, the better credit terms a company gets from its suppliers. From a company’s prospective, an increase in DPO is an improvement and a decrease is of course, "not good for business and cash flow". Value is a two-way street. Of course, vendors want to provide their clients with the best possible return on their investment. But they're a business, too. If a client makes a project difficult to staff, hard to schedule and costly to execute, more likely than not it will affect the initiative's outcome and value negatively. On the flip side, though, there are clients, even very large ones, that help vendors get through their internal processes, bureaucracy and political hurdles. Clients that smooth the way for vendor teams internally are going to get a superior value from their investment in our services. Effort will be spent on the work the vendor was hired to do, not on jumping through hoops. The vendor staffs up, their people get to work and they are able to focus – which always results in better quality and value at the end of the day. Once negotiations are closed, vendors want to shift their focus from winning the business to meeting the goals and expectations of their client. Yet they sometimes encounter major delays, bureaucratic hurdles and work stoppages based on internal processes and politics. This only hurts the client's project, yet it is often caused by the client organization's own internal structure and approach to management. So. Look at your vendor management processes. Would you want to work with you? Are you making your vendors happy? Do they have a fast-track, once you've signed with them? Or do they have to navigate a complex system of approvals and oversight? Are your schedules in alignment with theirs? Do your internal teams understand what's going on, who's involved and what the goals are? How many levels of management do they encounter? Do they have a point-of-contact with authority? Vendors usually expect to navigate these processes with every client. Even giant companies with hugely complex internal systems and challenging politics can get great value from their vendors by providing them with the tools and management resources they need from the start. As businesses invest millions into their technologies, and vendors do more and more of the work, any organization that engages with technology vendors on key initiatives risks a great deal by failing to be good to work with.

The benefits of integrating Vision360 Enterprise accounts payable processing with MS Dynamics:

- Seamless integration reduces the need for technical resources - Allows for rapid deployment - Accounts payable dashboard provides 100% visibility to supplier invoices - Eliminates 100% of paper invoices - Captures email invoices electronically - Eliminates the need for data entry - Powerful coding tools - Perform 2 & 3-way matching - Data validation engines ensures accuracy - Centralized processing and controls - Complete audit trail of approval activity - Generate instant efficiency reports - Instantly access invoices from electronic archive - Enforces your security, processing rules and compliance We do not take a one size fits all approach to any engagement. Our strength is in our ability to objectively evaluate the business problems and challenges that affect every day. By leveraging our business process solutions experience, coupled with our technical expertise we are able to effectively analyze and recommend a variety of viable solutions to fit the needs of any business problem and challenge we are faced with. For more information contact us or call 603-437-1400 x308  An Accounts Payable manager from Carolina Steel Group, LLC is heading to jail after being convicted of multiple counts of wire fraud and money laundering. During her time at the steel company, Angela Womack, 51, allegedly opened personal accounts under the name ‘IBOCF’ and would create vendor cheques payable to ‘International BOCF,’ attempting to cover her tracks by including them on the company’s vendor reports... read the full story. |

AuthorVision360 Enterprise Accounts Payable Automation Solution by BlueCreek Software reduces time wasted chasing down paper invoices by automating invoice approvals, eliminating manual data entry, eliminating paper invoices and reducing processing costs. Categories

All

Archives

September 2023

|

RSS Feed

RSS Feed