The Significance of Three-Way Purchase Orders: Enhancing Efficiency and Accuracy with AP Automation

In today's business landscape, optimizing operational processes is critical to achieving efficiency and accuracy in financial management. Among these processes, the three-way purchase order (PO) matching is a vital component of Accounts Payable (AP). In this article, we'll delve into why three-way purchase orders are necessary, explore ideas to improve this process, and examine how AI-based AP automation can streamline the PO match process, ultimately leading to touchless processing.

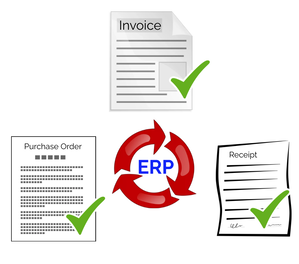

The Importance of Three-Way Purchase Orders: The three-way purchase order matching process is a crucial control mechanism in financial management. It involves matching three key documents: the purchase order, the supplier's invoice, and the receiving report or proof of delivery. This process serves several fundamental purposes: 1. Verification of Quantity and Quality: Matching the PO, invoice, and receiving report ensures that the quantity and quality of goods or services received align with what was originally ordered. This helps prevent overbilling, under-delivery, and incorrect shipments. 2. Accurate Invoicing: Three-way matching ensures that the supplier's invoice accurately reflects the goods or services received and the agreed-upon pricing. It mitigates the risk of erroneous charges, duplicate billing, and pricing discrepancies. 3. Fraud Prevention: By cross-referencing these three documents, organizations can detect irregularities and inconsistencies that may indicate fraud or unethical business practices. This adds an essential layer of security to financial transactions. 4. Financial Accountability: The three-way matching process enhances financial accountability by providing a clear, traceable trail of each transaction. This transparency is vital for compliance, auditing, and internal control purposes. Challenges in Three-Way Matching: While three-way purchase order matching is integral to financial operations, it comes with its own set of challenges. Manual three-way matching processes are often labor-intensive, time-consuming, and susceptible to errors. Here are some common challenges: 1. Human Error: Manual processes are prone to human errors, which can lead to discrepancies and reconciliation efforts. Mistakes in data entry, quantity verification, and document management are common. 2. Time-Consuming: Manual matching requires significant time and effort, delaying the approval and payment of invoices. This can strain supplier relationships and may result in missed early payment discounts. 3. Resource Intensive: The manual three-way matching process requires substantial human resources, diverting valuable staff from more strategic tasks. 4. High Operational Costs: Manual processes lead to higher operational costs, including printing, storage, and document management expenses. 5. Delayed Fraud Detection: Manual processes may not promptly detect fraudulent activities, putting the organization at risk of financial loss. Improving the Three-Way Matching Process: To address these challenges and improve the three-way matching process, organizations can consider several strategies and innovations: 1. Implementing AP Automation: One of the most effective ways to improve three-way matching is by implementing Accounts Payable automation. AP automation leverages AI and machine learning to streamline the matching process, reduce errors, and enhance efficiency. With automation, the three-way matching process can become faster and more accurate. 2. Enhancing Data Capture: Advanced OCR technology can capture data from invoices, purchase orders, and receiving reports accurately and rapidly. This improves the reliability of the matching process by ensuring that data discrepancies are minimized. 3. Automating Approval Workflows: Automated workflows ensure that invoices move through the approval chain promptly and consistently. This reduces delays and allows organizations to take advantage of early payment discounts. 4. Real-time Reporting and Analytics: AP automation provides real-time visibility into invoice processing, offering insights into the status of approvals, payments, and potential discrepancies. This transparency can help organizations make informed decisions quickly. 5. Compliance and Security: AP automation systems can enforce compliance with regulatory requirements and maintain a comprehensive audit trail. Additionally, they enhance data security through encryption and access control, reducing the risk of unauthorized access and data breaches. 6. Fraud Detection: AP automation can include fraud detection features that flag suspicious activities or discrepancies. This allows organizations to promptly investigate potential fraudulent transactions. 7. Integration with ERP Systems: Seamless integration with Enterprise Resource Planning (ERP) systems ensures that all financial data is promptly and accurately updated. This reduces the need for manual data entry and minimizes the risk of errors. AI AP Automation for Streamlining Three-Way Matching: AI-driven AP automation systems have the potential to revolutionize the three-way matching process. These systems offer several advantages that contribute to touchless processing: 1. Data Extraction and Verification: AI algorithms can accurately extract and verify data from invoices, purchase orders, and receiving reports. The technology can recognize patterns, discrepancies, and anomalies, ensuring that the documents align correctly. 2. Automated Matching: AI-driven systems can automatically match invoices with corresponding purchase orders and receiving reports. This process is rapid and highly accurate, reducing the risk of errors and discrepancies. 3. Fraud Detection: AI-powered AP automation systems can detect irregularities in the matching process that may indicate fraudulent activities. The technology can flag suspicious transactions for further investigation, enhancing financial security. 4. Real-time Reporting and Analytics: AI-based AP automation offers advanced reporting and analytics capabilities. Organizations can access real-time insights into the matching process, helping them make data-driven decisions quickly. 5. Improved Efficiency: AI automation reduces the time and resources required for three-way matching. This means faster approvals and payments, resulting in stronger supplier relationships and the ability to capitalize on early payment discounts. Conclusion: The three-way purchase order matching process is a critical component of Accounts Payable, ensuring that invoices align with purchase orders and receiving reports. Manual matching processes are often labor-intensive, time-consuming, and error-prone, leading to inefficiencies and high operational costs. To address these challenges, organizations can leverage AI-based AP automation to streamline the matching process, reduce errors, and improve efficiency. With the implementation of AP automation, organizations can achieve touchless processing, enhancing accuracy, compliance, and financial accountability. Embracing this technology is not just a financial decision; it's a strategic move that transforms how organizations operate, ensuring efficiency, accuracy, and competitiveness in the modern business landscape. |

Additional articles:

Navigating Reluctance: Understanding Why Companies Hesitate to Implement Invoice Process Improvements The Power of Efficiency: Calculating Time and Cost Savings in the Accounts Payable Process with AP Automation Revolutionizing Efficiency: The Comprehensive Benefits of Implementing Accounts Payable Automation in Organizations The Costly Pitfalls of Manual Invoice Processing Why BlueCreek Software: A Game Changer for Efficiency with Vision360 Enterprise Maximizing Cost Savings: How CFOs Can Leverage Invoice Process Improvements A Day in the Life of an Payables Department: Unveiling the Essentials The Significance of Three-Way Purchase Orders: Enhancing Efficiency and Accuracy with AP Automation Vision360 Enterprise: Transforming Controllers' Roles and Why They Love It Revolutionizing Accounts Payable: The Power and Potential Concerns of AI Invoice Processing How AP Automation Transforms Finance at Every Level Getting Started: Steps to Streamline and Optimize the Entire AP Process Unlocking Efficiency and Savings: The Benefits of Invoice Optimization |