If you’re the Accounts Payable Manager chances are you’ve heard of “accounts payable automation”. You’ve probably seen marketing materials or even done some homework to find out what this is all about. When you hear or read about AP automation the idea sounds magical, almost too good to be true! No more paper invoices to process! No more back and forth getting invoices approved! No more manual data entry into the ERP! All with a savings between 60 to 80 percent of costs! Sounds too good to be true, right? Wrong! And here’s why.

When it comes to AP Automation there are two types of savings, “hard dollar savings” and “soft dollar savings”. AP Automation encompasses both hard and soft savings which allows business to sustain long-term continued savings as opposed to one-time short term savings. Hard Dollar Savings: relates to reducing the costs from the current cost to a new lessor amount or a change in process/technology/policy that directly reduces expenses, and process improvements. Hard dollar savings are generally easier to calculate and quantify. Soft Dollar Savings: Soft savings relate to those areas that reduce costs through less labor, more efficiency, productivity increase, usable information, better compliance, better work environment, and other related areas. These types of soft savings are generally hard to calculate and quantify because there are so many variables and activities involved. What many organizations fail to understand and do not realize or accomplish is how to continue sustainable improved cost savings through both hard and soft cost savings. According to the trade associations like, Aberdeen Group, PayStream Advisors, IOFM and many other organizations who have studied accounts payable processing over the last several years have determined a few very important facts:

* Source: Aberdeen Group and PayStream Advisors Accounts Payable Report The best way to identify all of the potential costs is to create a “flow” or “map” of your current accounts payable process. This will help you to think through the entire process and identify areas of concern and bottlenecks which can be identified as areas of improvement and savings. In determining your own hard and soft costs to process supplier invoices there are a few things to consider i.e. the tasks involved, how many people within the AP department that are involved in each task, the amount of time it takes to complete each task, are there any people outside of the AP department, what is their task, how much time is needed etc. Also include any monetary costs or penalties caused by tasks that are not completed on time or incorrectly, i.e., fines, penalties, late fees, overtime, temporary help, etc. Typical tasks associated with processing supplier invoices:

These steps represent tasks that are accomplished typically within the AP department and don’t extend to others outside the department so it is important to consider and calculate those costs as well and how others are impacted, the amount of time involved, costs, etc. For each task quantify the amount of time it takes, i.e. if it takes 1 person 20% of their time to open and sort the incoming invoices from the mail and they are being paid $45,000 annually then the cost to open and sort the mail is $9,000 dollars. Task # of People % of Time Salary Total Cost Open & Sort Mail 1 Person 20% $45,000 $9,000 If it takes 2 people 60% of their time to key invoices into the accounting system and they are being paid $45,000 annually, then the cost to manually enter invoices in to the accounting system is $54,000 dollars. Task # of People % of Time Salary Total Cost Manually Key Invoices 2 People 60% $45,000 $54,000 If it takes 1 person 40% of their time to file paid invoices into the paper filing system and they are being paid $35,000 annually, then the cost to manually file invoices away s $14,000 dollars. Task # of People % of Time Salary Total Cost File Paper Invoices 1 People 40% $35,000 $14,000 Without quantifying and calculating the entire accounts payable process from start to finish you can at least see that just by quantifying the three key areas of 1) opening mail and sorting invoices, 2) manually keying invoices into the accounting system and 3) filing away the paid invoices we’ve calculated an annual cost of $77,000. Once you quantify and calculate all of the costs associated with the tasks of processing supplier invoices and also take into consideration the monetary costs caused as a result of inefficient, error-prone manual processes the annual cost to process supplier invoices RISES significantly and fast. Here are five additional facts to help you in calculating your costs to process supplier invoices and potential ROI. 1) The average number of invoices with errors is approximately 3.6% (per IOFM). Now, that number may not seem like a ton, but consider if you organization has $100MM in payables pumping through it over the course of the year. If $3.6 MM was paid to the wrong vendor, or for the wrong invoice, or in the wrong amount...you get the picture. The sum of these errors equals a total nightmare for reconciliation in the accounts payable process and unnecessary extra work to unscramble the eggs. 2) The industries with the highest average cost to process an invoice are Non-Profit / Education at $16.78/invoice and Government at $15.86/invoice. While this doesn’t really come as a surprise, it underscores the need for accounts payable process improvement across all manner of organizations. With many corporate leaders having no actual clue to how much their inefficient invoice processing is costing them, it’s high time that they wise up to these AP process leaches and identify ways to make AP strategic and profitable (and no, that is not an oxymoron, it’s entirely possible). 3) Nearly 62% of invoice processing costs are made up of staff labor (per APQC). The real issue here is how much time is needed to advance an invoice in process. This includes data entry, data validation (matching the data from the invoice against disparate information like vendor master, PO table, and receiving data), GL coding, and approving. The bottom line is that the accounts payable process is very fat from a time consumption standpoint and needs to be leaned out if you have any hopes of dropping your processing costs and improving your AP process cycles. 4) For the average company, over 50% of eligible early payment discounts go uncaptured because of inability to process invoices and execute payment in a timely manner (per Aberdeen Research). This means that significant opportunities to pad the bottom line are squandered, again because of a grotesque AP process. Ironically, it’s our belief that, given the option, most CFO’s and Treasurer’s would likely want to capture discounts as they tend to be free monies to the payer, when done properly. This again is a compelling reason to pursue automation. 5) On average, only 32% of companies harness Accounts Payable process dashboards to monitor and optimize performance within their AP departments (per Aberdeen Research). This only serves to underscore just how in the dark most AP and finance leaders are. When you consider that most sales and marketing executives have rich insights into their customer and prospect pipelines you can understand that there is a definite gulf between investment in top line revenue generation systems and bottom line, back office systems. This kind of thinking must be challenged, because AP automation need not be a financial boondoggle, but instead could be a transformative organizational profit center, that catalyzes further finance and operations improvements. In addition to the costs saved there are a number of additional ROI and savings that are often overlooked. The ROI of Control: Though many in the AP industry feel they are giving up control by automating their AP process that just isn’t true. When you introduce these new found efficiencies into your AP department you’re not eliminating your role in the process. Rather, you are automating aspects of that process that unnecessarily consume large amounts of your time, cause errors and are simply inefficient. With AP automation, you are still in control of coding invoices, approving invoices and promoting them to the general ledger. You and your AP team will have greater visibility and insight into the entire AP process and with greater visibility means greater control. The ROI of Time: Once the immediate savings are realized and the process is automated, you might wonder, “What’s next?” After all, you just saved your AP department a lot of work. What will they do with their new time? With their new time, many companies have transformed their AP department from an expense to a profit center by pursuing higher-level tasks, such as: early vendor payments, performing more analysis, spend control, working with vendors, electronic payment incentive programs, and rebate programs. They are now generating revenue for their company. The ROI of Scalability: As captivating as the aforementioned immediate savings are, one of the greatest returns found through automation occurs years down the road. As your company grows, as invoice volumes increase, you will be able to retain the same AP staff, handle more invoice volume WITHOUT the need to add more AP staff. In a recent AP Department Benchmarks & Analysis survey conducted by the Institute of Finance & Management, only one-third of companies surveyed have implemented document capture and only 25 percent use some form of e-invoicing. This indicates that many companies are still tied up in manual paper processing. The same study notes that those companies that have implemented automation systems are twice as productive as those that haven’t. Part of the reason a surprisingly large number of companies are still manually processing their AP transactions is they are often not aware of the factors that are sucking time from staff and costing the company money. One of the more costly elements of getting an invoice paid is the waiting involved in gathering all of the necessary approvals and associated paperwork. This workflow typically runs across multiple departments and requires the attention of busy decision-makers. By automating the AP workflow, most of the waiting periods are shortened as the system simplifies, automates, and secures approvals and decisions. But saving money and by saving time is just the start of the benefits of AP automation.

0 Comments

“The average cost of processing an invoice in an environment with no automation or low levels of automation can be up to 20 times greater than the cost of processing in a fully automated environment.”

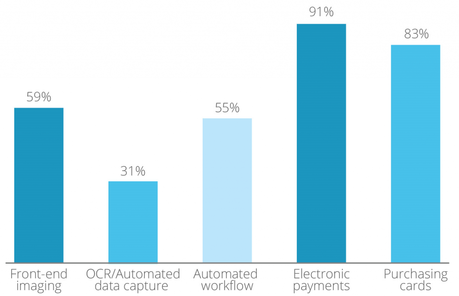

Is your Accounts Payable (AP) department buried in invoice processing that is mired with manual tasks and exceptions? Paper-based vendor invoice processing is time consuming and expensive and creates chaos in business. Manual processing is error-prone with little or no controls or visibility and leads to invoice approval delays, late payment fees, and missed discount capture; in addition to creating delays in month-end, and year-end closing. When you factor in the countless clerical hours that AP personnel consume to manually reconcile, research and resolve invoice issues and exceptions rather than focus on strategic AP tasks, it’s no surprise why more companies are striving to increase automation and reap the rewards of straight-through invoice processing to save both time and money. PayStream Advisors research reveals the average cost of manually processing an invoice can be as high as $20, versus $3 or less for automated invoice processing. The average cost of processing an invoice in an environment with no automation or low levels of automation can be up to 20 times greater than the cost of processing in a fully automated environment. Research shows the three biggest advantages to AP automation include: 1. Increased Efficiencies – Significant time is saved when employees do not have to manually process, match, and data enter paper-based invoices by hand. Automation dramatically increases invoice cycle time. 2. Ability to Capture Discounts – Invoice automation speeds the invoice processing cycle and allows companies to take advantage of early payment discounts and avoid late payment penalties. 3. Improved Visibility – Automation solutions available on the market today provide real-time access to invoice and payment status, providing quicker handling of reconciliation questions and fewer calls to the AP department. According to PayStream Advisors 2014 Benchmarking report titled Capturing Competitive Advantage, more companies plan to implement invoice automation over the next year, see Figure 1, to reap a multitude of benefits that AP automation delivers, see Figure 2.

Figure 1 – “Companies Plan to Implement AP Invoice Automation”.

PayStream Advisors 2014 eInvoicing Benchmark report reveals the top benefits of automating AP with fewer lost or missing invoices ranking first, see Figure 2.Figure 2 “What benefits do you see from AP Automation?”

Source: PayStream Advisors 2014 eInvoicing Benchmark Report

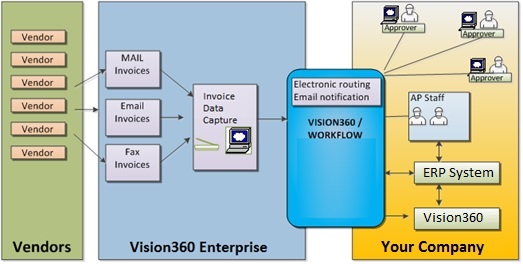

Partnering with a leading cloud-based AP invoice automation solution provider like Vision360 Enterprise can reduce processing costs by up to 90 percent by maximizing straight-through invoice processing for both PO-based and non-PO or expense invoices. By streamlining invoice data capture and validation and applying powerful, flexible matching, automatic coding and approval best practice workflows, organizations of all sizes benefit from a truly automated AP solution delivering productivity and efficiency coupled with visibility and control. While many invoices lack a PO, the Vision360 Enterprise solution has the ability to quickly process all non-PO invoices straight-through to the appropriate approver and eliminating long processing times. Vision360 Enterprise puts spend controls in place to provide pre-approval that reduces maverick spend, transforming expense invoices into order-based invoices that can be automatically matched; resulting in fewer expense invoices and fewer manual approvals. To further streamline the invoice processing cycle, any recurring expense invoices can be automatically matched against an invoice schedule as part of a procurement contract, further reducing manual intervention and maximizing straight-through processing including automatic invoice coding and approval against configurable business thresholds. This minimizes the risk for manual errors, while providing increased control and focus on handling invoice exceptions. The Vision360 Enterprise solution provides market-leading matching capabilities that allow companies to benefit from dynamically applying automated two, three, and four-way matching. Vision360 Enterprise delivers scalable invoice processing that achieves optimal AP efficiency for companies large and small, including SMB’s that process a few thousand invoices per year to global corporations that process millions. The solution provides powerful coding tools that can automatically code and distributes invoices based on predefined business rules for quick and easy invoice approval. All approvals are tracked in the audit trail to guarantee compliance with both internal and external rules and regulations. The solution also includes a digital invoice archive that enables users to quickly access processed invoices. Both the invoice and all relevant data are retained for future reference. Built-in robust reporting and dashboard functionality empowers users to track AP performance by invoice cycle times, invoices processed, discounts captured, invoice error rates, and other variables. Vision360 Enterprise provides a complete invoice processing solution that was designed with packaged best practices for invoice management and workflow, see Figure 3. The solutions key features include one capture channel for all invoices (Paper, PDF, XML etc.), dynamic business rule based validation, granular automated coding and distribution for efficient invoice management, easy state-of-the-art reporting functionality for full invoice process and transparency. Figure 3 “Vision360 Enterprise – A True AP Invoice Automation Solution”

The Vision360 Enterprise solution can be easily integrated into most ERP and accounting solutions to provide a future-proof investment, providing a consistent, scalable and intuitive operating environment anytime, from anywhere, making it the perfect solution for all users across an enterprise. Speed to value is assured through a cloud-based solution leveraging unrivaled matching functionality and packaged best practice AP automation workflows coupled with immediate user adoption due to Vision360’s intuitive user friendly interface.

Vision360 Enterprise solution is ease-of-use, provides unlimited scalability and increased control of the entire invoice process among top differentiating points that distinguish the Vision360 Enterprise solution from other invoice automation solutions on the market. To learn more about Vision360 Enterprise and the benefits it can deliver to your company, please visit our website at www.Vision360Enterprise.com

Here Are 5 AP Processing Facts to Consider.

AP automation brings increased internal visibility and control which organizations can take advantage of. They are able to uncover opportunities to generate savings and optimize cash management. With the visibility that automation brings into invoice and payment data, finance departments can analyze and understand expenditure, perform budget variance analysis, and spot possible fraudulent behavior. Here are five facts to consider if you’re organization is still relying on manual invoice processes. 1. The average number of invoices with errors is approximately 3.6% (per IOMA). Now, that number may not seem like a ton, but consider if you organization has $100MM in payables pumping through it over the course of the year. If $3.6 MM was paid to the wrong vendor, or for the wrong invoice, or in the wrong amount...you get the picture. The sum of these errors equals a total nightmare for reconciliation in the accounts payable process and unnecessary extra work to unscramble the eggs. 2. The industries with the highest average cost to process an invoice are Non-Profit / Education at $16.78/invoice and Government at $15.86/invoice. While this doesn’t really come as a surprise, it underscores the need for accounts payable process improvement across all manner of organizations. With many corporate leaders having no actual clue to how much their inefficient invoice processing is costing them, it’s high time that they wise up to these ap process leaches and identify ways to make AP strategic and profitable (and no, that is not an oxymoron, it’s entirely possible). 3. Nearly 62% of invoice processing costs are made up of staff labor (per APQC). The real issue here is how much time is needed to advance an invoice in process. This includes data entry, data validation (matching the data from the invoice against disparate information like vendor master, PO table, and receiving data), GL coding, and approving. The bottom line is that the accounts payable process is very fat from a time consumption standpoint and needs to be leaned out if you have any hopes of dropping your processing costs and improving your ap process cycles. 4. For the average company, over 50% of eligible early payment discounts go uncaptured because of inability to process invoices and execute payment in a timely manner (per Aberdeen Research). This means that significant opportunities to pad the bottom line are squandered, again because of a grotesque ap process. Ironically, it’s our belief that, given the option, most CFO’s and Treasurer’s would likely want to capture discounts as they tend to be free monies to the payer, when done properly. This again is a compelling reason to pursue automation. 5. On average, only 32% of companies harness Accounts Payable process dashboards to monitor and optimize performance within their AP departments (per Aberdeen Research). This only serves to underscore just how in the dark most AP and finance leaders are. When you consider that most sales and marketing executives have rich insights into their customer and prospect pipelines you can understand that there is a definite gulf between investment in top line revenue generation systems and bottom line, back office systems. This kind of thinking must be challenged, because AP automation need not be a financial boondoggle, but instead could be a transformative organizational profit center, that catalyzes further finance and operations improvements.

Too Many Other Priorities: The accounts payable department is often times low on the totem pole when it comes to priorities. So many times there are too many other initiatives that bump accounts payable automation from the priority list due to availability of resources and funding.

Accounts payable automation has been a proven method of reducing operational costs, improving cash flow and eliminating non-essential manual tasks. There are many resources available to support a business case in favor of accounts payable automation including studies from Paystream Advisors, The Aberdeen Group and many more! Also, many systems today are deployed as SaaS, Web Hosted or Cloud which require very little IT resources and have less up-front costs than traditional software or OCR based systems. It's Too Confusing: There are so many systems, acronyms, solutions and choices that it is too confusing to know which is best for us. When selecting an accounts payable automation solution provider it is always important to look at experience, scalability and cost of ownership. In-house vs Out-Sources and Cloud vs Software. Many providers offer a multitude of solutions that can fit a wide variety of needs. Be sure to speak with references as they will be willing to share their experience with accounts payable automation. Fear of Change: Accounts payable automation has been around for many years now and is not a new concept by any means. One of the fears of AP Automation is, loss of jobs. If you're an AP manager you might be thinking, "Will have to let people go?" If you're an accounts payable clerk you might be thinking, "Will they no longer need me?" The reality is that the accounts payable team will be much more productive and be able to focus on financial tasks, spend control and analysis that will further save the company money rather than chasing invoices for processing. The best way to plan for change is to listen to those that have done this before you. Chances are you may know someone in a peer group, someone in a similar role at another company that can share their experiences that will help you in the planning process. There is an endless amount of available resources to help you sort through the myriad of available solutions including Aberdeen Group, Paystream Advisors, Linked Groups, White Papers and AP Webinars. Do you your homework, build your case and don't let fear of change stop you from achieving you goal of Accounts Payable Automation!

Accounts Payable departments have a huge potential to drive change in financial operations. By introducing automation, they can remove repetitive tasks from the AP process, and substantially contribute to better overall financial performance. In a recent study Paystream Advisors concludes that 'the quest to go digital [in accounts payable] has never been more appealing”.

AP automation brings increased internal visibility and control which corporate controllers can take advantage of. They are able to uncover opportunities to generate savings and optimize cash management. With the visibility that automation brings into invoice and payment data, controllers can analyze and understand expenditure, perform budget variance analysis, and spot possible fraudulent behavior. As Controller’s wonder, “What’s in it for me? Here are five ways controllers benefit from accounts payable automation which aligns with the five main needs that Controllers have for accounts payable efficiencies: 1. Internal controls & transparency: It is critical that the accounts payable system support internal control. The needed controls should be built in to the workflow of the AP system. This way, the system acts as an “automated” internal control. 2. Flexible & multi-dimensional coding: Ideally, the accounts payable automation software should perform automatic coding based on purchase order or contract matching. However, the coding needs to be flexible and multidimensional. In situations where coding is not automated, details need to be available with historical information about past coding for a given supplier. 3. Access to different levels of invoice data: As accounts payable becomes automated, people who deal with a particular cost center, category or supplier need to have many views available to them. They should be able to drill down all the way to the individual invoice level. Within different views of the invoice data, controllers need to be able to easily categorize, group, and perform aggregate calculations. Also, they need to access conversations and attachments related to individual invoices in order to improve supplier relationships. 4. Tools for in-depth analytics and reporting: Access is key. Controllers need to be able to sort invoices by vendor, by account or by cost center, and search all invoice fields. They should be able to perform budget variance analysis and detailed expense analysis at row-level by vendor on an ongoing basis. If necessary, this analysis should drill down to the invoice image. Analysis is done to study e.g. average purchase per vendor, or number of overdue invoices. 5. Accruals: When you do not have visibility into individual invoices, accruals can be “a black hole”. The accounts payable automation system should monitor and extract information about the invoices that are still in circulation, and allow controllers to work with accountants to include reported invoices into the accruals. Once the accruals are done, controllers should get the lists for reviewing and checking. |

AuthorVision360 Enterprise Accounts Payable Automation Solution by BlueCreek Software reduces time wasted chasing down paper invoices by automating invoice approvals, eliminating manual data entry, eliminating paper invoices and reducing processing costs. Categories

All

Archives

September 2023

|

RSS Feed

RSS Feed