Imagine 100's to 1,000's of Supplier Invoices Processed Without Any Manual KeyingThe accounts payable process can be a time consuming and labor-intensive process. Invoices arrive on a daily basis, some be email and some by postal service. The accounts payable staff generally have a daily routine which involves a few things:

Once the supplier invoices are organized and invoices that require approval are then distributed to the approvers for review, approval and assignment to the ledger. The approval process comes with it's own set of challenges:

If procurement is issuing Purchase Orders, then any incoming invoices that reference an issued purchase order will have a PO number on it. The invoices with PO numbers will need to be matched against the actual Purchase Order to ensure there are no discrepancy with the pricing or items ordered.

In order to process invoices for payment the AP Staff are required to enter invoices into the financial system in order to issues the payment to the supplier. The process of entering invoices requires the AP Staff to manually key all of the relevant details on each and every invoice into the financial system. Not only is this a very slow process, this isn't make very good use of the AP Staff's time.

The traditional approach to processing accounts payable invoices relies heavily on people and manual processes. With advent of Accounts Payable Workflow it made it easier to automatically route invoices to approvers using electronic workflow queues. Now let's take that a step further as Accounts Payable Automation leverages both invoice workflow and automated PO invoice matching and by combining both of these with integration to the financial system the ability exists to completely eliminate the need to manually enter or key invoices for payment processing.

0 Comments

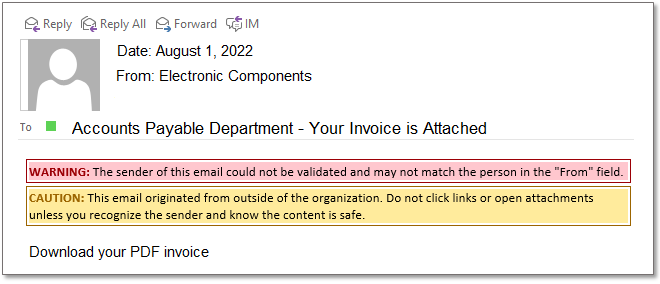

We've all seen the red highlighted message at the top of an email, "CAUTION! IF THIS EMAIL ORIGINATED OUTSIDE OF THE ORGANIZATION DO NOT CLICK ON ANY LINKS". Does your Accounts Payable Process rely on suppliers emailing invoices to your business and your AP Staff then open each email one-by-one, download a PDF or file to their computer and then print each invoice to paper. "EMAIL IS THE NUMBER ONE METHOD USED BY HACKERS TO EXPLOIT AN ORGANIZATIONS INFRASTRUCTURE, GAIN ACCESS AND STEAL INFORMATION" An AP Automation platform like, "Vision360 Enterprise", eliminates the need for AP Staff to open emails, download PDF files and print invoices. This dramatically reduces the risk of fraudulent emails exposing an organization to potential hacking or phishing schemes. In addition, this is an incredible time saver by reducing the amount of time and energy it takes an AP Department to open and print emails. An AP Automation platform like "Vision360 Enterprise" will apply a series of business rules and validations against the incoming invoices to further ensure that they are being submitted from "legitimate vendors". By having centralized processing coupled with consistent internal controls that are applied systematically and not relying on human intervention the risk of potential fraud is greatly reduced. What are computer hackers? Computer hackers are people who break into internet-connected devices such as computers, tablets and smartphones, usually with the intent to steal, change or delete information. Just as other thieves have malicious intent, hackers usually find their way into devices for negative purposes. (However, one exception is so-called white hat hackers, whom companies hire to break into their devices to find security flaws that need to be fixed.) Hackers may want to steal, alter or delete information in your devices, and they often do so by installing malware (software used for malicious purposes) you might not even know is there. These thieves might get access to your most precious data before you’re aware of a break-in. Types of hacking: Ransomware is on the rise! Here are some of the reasons computer hackers break into devices:

Accounts Payable Automation systems can modernize your invoice processing by reducing risk, providing cost control and increasing efficiencies. Please consider registering for one or our informational webinars or contact us directly for more information.

You advertise for an open AP Specialist position. The ad reads something like this: Description Our team is seeking an Accounts Payable (AP) Specialist who will be responsible for processing (i.e., coding and entering) and paying vendor invoices and employee expenses in a timely manner. Essential Functions

You seek a candidate with relevant job experience, skilled in accounting practices, they will be involved in the cash flow for your business, the need to make quick business decisions that effect your supply chain and vendor relationships. However, with all this in mind, they will spend between 40 - 60 percent (or more) of their day manual keying invoices into the financial system for payment processing. Seems like all this experience could be used to better serve the business and their interest in a career in accounting. You went through the process of advertising (costs money), interviewing candidates (costs time & money), hiring and training the new hire (costs time and money) and in the end they spend more time keying invoices than any other function. Does manual invoice keying make the best use of your AP Staff's time?

It's Month End Again!! Can This Really Help??Month-end close is critical to an organization’s financial health and performance. The ability to know your financial status accurately and consistently – including expected purchase costs, cash flow, and outstanding liabilities – will determine your profit/loss and inform key business decisions. Accounts Payable (AP) plays an integral role in the process. Root causes of inefficient manual paper-based month-end processing. Lack of Visibility. Tracking current progress into financial close and accounts payable processes is essential for every organization. Without real-time updates, finance and accounting leaders may find it difficult to navigate the status of essential close tasks and AP transactions. Increased Errors. The more manual your tasks are, the more susceptible those tasks are to errors. Relying on human intervention for tasks that can be easily automated not only burdens accountants to repetitively track transactions and reconcile them, but it also increases the potential for violating compliance regulations. Ineffective Controls. Financial data affects the entire organization. Accounts payable teams must manually upload invoices and transactional updates into ERP systems, while accounting teams are dependent on the general ledger information when performing reconciliations to ensure their internal controls are being met. Without a standardized and automated process in place, F&A teams may find difficulty in achieving comprehensive compliance. How AP Automation helps. Closes are faster. An automated AP system enables invoices to flow into the organization quickly and automatically, so all transactions are accounted for, even up to the last minute, without requiring AP to manually key anything in. This enables Accounting to know what is really going on at any point in time, and it can use that real-time info to close faster. Visibility Visibility across all invoices enables the AP and Accounting departments to see which invoices have been received, which need to be approved and where they are in the process. Outstanding liabilities are no longer a guessing game, but rather are accurately captured by the system. A centralized invoice receiving process and automated routing capabilities mitigate the problem of lost invoices and, more importantly, the need to hunt for them before routing them to approvers. Better fraud prevention. The ability to detect anomalies, which is enhanced by AI capabilities, machine learning, data validation and enforcement of business rules, helps to prevent fraud. Fewer errors Manual data entry inevitably results in human error. With electronic data capture technology, you get over 99% accuracy on every invoice. Plus, the automation system flags any suspicious invoices for manual review. That lets you catch potential problems and take care of them early on. Real-time reporting and data analysis With financial automation software, users are able to view real-time dashboards that display vital information regarding the status of a financial report. With access to real-time data, a business can make decisions based on factual data at any time without waiting for the end of the month to have access to accurate data. Vision360 Enterprise is an AP Automation platform intended to assist in streamlining all aspects of accounts payable invoice processing. For more information consider attending one of our information webinars or contact us directly and we'll be happy to answer any questions.

|

AuthorVision360 Enterprise Accounts Payable Automation Solution by BlueCreek Software reduces time wasted chasing down paper invoices by automating invoice approvals, eliminating manual data entry, eliminating paper invoices and reducing processing costs. Categories

All

Archives

September 2023

|

RSS Feed

RSS Feed