It's Time to Connect the Last Mile Between Accounts Payable Processing & ERP Systems!

“Productivity” and “Visibility” are the rallying cries of today’s financial executives - and they’re also the promise of ERP systems. But ERP nirvana can’t be attained until it extends to all of an organization’s core financial processes, particularly the function that pays the bills - accounts payable! The benefits - increased productivity, reduced costs, strengthened vendor relationships and better compliance - are too good to stop short. By connecting accounts payable processing with your ERP system AP Departments can now take full advantage of productivity and efficiency gains that an accounts payable automation system provides. The benefits of integrating accounts payable processing with the ERP system. - Seamless integration reduces the need for technical resources - Accounts payable dashboard provides 100% visibility to supplier invoices - Eliminates 100% of paper invoices - Captures email invoices electronically - Eliminates the need for manual invoice entry - Powerful GL coding engines - Powerful 2, 3 & 4-way matching engines - Powerful tax rules engines - Powerful freight rules engines - Data validation engines ensures accuracy - Centralized processing and financial controls - Complete audit trail of approval activity - Generate instant efficiency reports - Instantly access invoices from electronic archive - Enforces your security, processing rules and compliance - Always know EXACTLY how efficient your AP department is functioning We do not take a one size fits all approach to any engagement. Our strength is in our ability to objectively evaluate the business problems and challenges that affect every day. By leveraging our business process solutions experience, coupled with our technical expertise we are able to effectively analyze and recommend a variety of viable solutions to fit the needs of any business problem and challenge we are faced with. Connect the last mile between accounts payable processing and ERP systems.

0 Comments

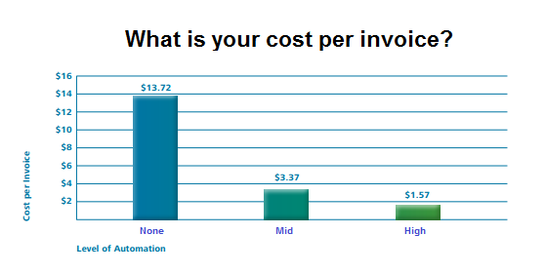

Invoice processes costs vary greatly and are closely linked to the level of accounts payable automation and productivity gains.

The levels of automation shown here are: 1. No automation. 2. Partial automation, such as scanning invoices. 3. Full automation, comprised of scanning and information capture coupled with a business rules engine to enable touchless processing of the majority of invoices as well as integration between the automated process and a company's ERP system. Invoice processing cost comparisons clearly demonstrate how valuable accounts payable automation is to the bottom line of any organization, no matter the size or scale. When a routine job is automated, the resulting efficiencies and cost savings open up learning and development opportunities for staff. The shift caused by automation is one that moves staff from “routine work” to “knowledge work” and this contributes significantly to continuous business improvement and staff job satisfaction. Perceived barriers to automation: With automation shown to be the best route to increased productivity, one might wonder why more organisations have not employed this tool in their accounts payable departments. There are many reasons for this: 1. Within some organizations, internal IT departments can be perceived as a roadblock. Understandably, IT departments handle many requests for various competing projects with limited resources. So it is important to build a compelling business case to ensure your project gains the appropriate support. 2. There is no “one size fits all” software or solution on the market. This can add complexity to the decision-making process but also delivers the benefit of a tailored solution to meet an organization’s existing and future needs. 3. There is a perception that accounts payable automation requires an “all or nothing” approach, which again adds to perceived complexity and effort. In fact automation can take place step by step. 4. Another factor is the fear that suppliers will walk away if you ask them to do something new or different – but in reality this is highly unlikely. 5. Finally, in many organizations, there is a fear of automation – and that it might place jobs at risk. “While automation undoubtedly has a short term effect on particular workers who have grown accustomed to their present habits, it does not show any trend of decreasing the overall size of the economy, or of decreasing the number of jobs available.” When a routine job is automated, the resulting efficiencies and cost savings open up learning and development opportunities for staff. The shift caused by automation is one that moves staff from “routine work” to “knowledge work” and this contributes significantly to continuous business improvement and staff job satisfaction. Courtesy of Accounts Payable Benchmarking Report 2014 |

AuthorVision360 Enterprise Accounts Payable Automation Solution by BlueCreek Software reduces time wasted chasing down paper invoices by automating invoice approvals, eliminating manual data entry, eliminating paper invoices and reducing processing costs. Categories

All

Archives

September 2023

|

RSS Feed

RSS Feed