Accounts Payable Workflow & AP Workflow Software

|

What is a accounts payable workflow in an accounts payable department? With an AP Workflow software system organizations of all sizes can completely eliminate the manual steps involved with receiving, approving, coding , matching and hand entering supplier invoices for payment. Our Vision360 Enterprise Accounts Payable Automation Workflow system is a software system that does not require you to purchase anything. Your Accounts Payable Department will be able to manage the entire payables process from their very own AP Dashboard that will provide them with all of the KPI's, Reports and Analytics to drive savings, performance and efficiencies.

|

|

A day in accounts payable should really be called, Mission Impossible! Why you ask? The department and responsibilities of the staff go well beyond paying bills and invoices. There are many responsibilities, factors, variable and duties to consider. Using an Accounts Payable Workflow software system such as Vision360 Enterprise many of the following manual tasks are eliminated.

|

|

|

|

|

Read out our latest guide "The Ultimate Guide to Accounts Payable Automation" to learn more!

AP Workflow Software

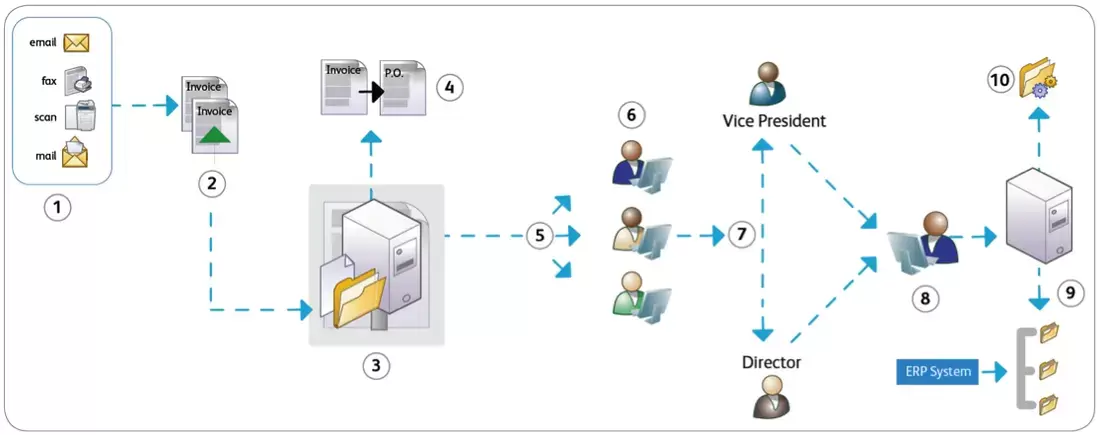

With Vision360 Enterprise invoice workflow software, accounts payable departments can automate their accounts payable workfow process and expect to eliminate all of the manual touch points and processes associated with process, paying and maintaining supplier invoices.

With Vision360 Enterprise workflow there is nothing to purchase, no software licensing restrictions, no annual software maintenance and very little IT resources needed. Vision360 Enterprise automates the routine steps involved in approving invoices. Once supplier invoices are captured, the invoices can be routed to approvers using the Vision360 Enterprise based on business rules, through multiple levels of approvals, coded and released for payment.

With Vision360 Enterprise workflow there is nothing to purchase, no software licensing restrictions, no annual software maintenance and very little IT resources needed. Vision360 Enterprise automates the routine steps involved in approving invoices. Once supplier invoices are captured, the invoices can be routed to approvers using the Vision360 Enterprise based on business rules, through multiple levels of approvals, coded and released for payment.

|

|

|

A Typical AP Automation Workflow Process From Receiving Supplier Invoices to Posting for Payment

What are some typical accounts payable related challenges?

What challenges do AP departments face within the traditional manual workflow?

AP departments face several challenges within the traditional manual workflow. These challenges can include slower processing times, increased risk of errors, lack of visibility into the process, difficulty in tracking invoices, and limited scalability.

Why is it important to know and understand the steps of the accounts payable workflow?

It is important to know and understand the steps of the accounts payable workflow in order to efficiently manage the AP process. Having a clear understanding of the workflow helps in streamlining operations, reducing errors, and ensuring timely payments.

What does the accounts payable workflow encompass?

The accounts payable workflow encompasses the complete end-to-end process of obtaining goods and services, as well as the processing and payment of invoices related to those transactions.

AP departments face several challenges within the traditional manual workflow. These challenges can include slower processing times, increased risk of errors, lack of visibility into the process, difficulty in tracking invoices, and limited scalability.

Why is it important to know and understand the steps of the accounts payable workflow?

It is important to know and understand the steps of the accounts payable workflow in order to efficiently manage the AP process. Having a clear understanding of the workflow helps in streamlining operations, reducing errors, and ensuring timely payments.

What does the accounts payable workflow encompass?

The accounts payable workflow encompasses the complete end-to-end process of obtaining goods and services, as well as the processing and payment of invoices related to those transactions.

What are some other ways that AP Workflow can help an organization?

How does workflow make it easier to reconcile finances and access data for analysis and insights?

Workflow makes it easier to reconcile finances and access data for analysis and insights by eliminating manual tasks and providing real-time visibility into the accounts payable process. Automated systems can generate reports and analytics, allowing businesses to gain valuable insights, identify trends, make data-driven decisions, and streamline financial reconciliation processes.

How does automation improve security in the accounts payable process?

Automation improves security in the accounts payable process by reducing the risk of human error and potential fraudulent activities. Automated systems can implement robust security measures, such as encryption and access controls, to safeguard sensitive financial information and prevent unauthorized access.

What are the benefits of early payment discounts or virtual payment cashback rewards?

By streamlining the accounts payable workflow, businesses can take advantage of early payment discounts offered by suppliers. This enables them to save money by paying invoices promptly. Additionally, businesses may also benefit from virtual payment cashback rewards, further enhancing their financial gains.

Why can suppliers rely on businesses that have streamlined accounts payable workflows?

Suppliers can rely on businesses that have streamlined accounts payable workflows because automation ensures that invoices are processed efficiently and accurately. This reduces the likelihood of delays or errors in payment, providing suppliers with confidence in receiving their funds on time.

How does streamlining the accounts payable workflow using automation make a business more competitive?

Streamlining the accounts payable workflow using automation makes a business more competitive because it allows for prompt and effortless payment to suppliers. This reliability builds trust and confidence with suppliers, giving the business a competitive edge.

How does workflow improve security?

Automation improves security by reducing the risk of errors, fraud, and unauthorized access to sensitive financial information. Manual processes are more prone to human error and can be susceptible to fraudulent activities. Automation, on the other hand, ensures consistent and controlled processes, enforcing approval rules and maintaining compliance. This helps safeguard your financial transactions and protects against potential security breaches.

How does workflow enable you to reap the benefits of early payment discounts or virtual payment cashback rewards?

Automation enables you to reap the benefits of early payment discounts or virtual payment cashback rewards by accelerating the payment process. With automated workflows, invoices can be processed and approved quickly, allowing you to take advantage of early payment discounts offered by suppliers. Additionally, automation can facilitate virtual payment methods, such as credit cards, that offer cashback rewards, providing you with additional financial benefits.

How does workflow ensure prompt and effortless payment to suppliers?

Automation ensures prompt and effortless payment to suppliers by eliminating manual touchpoints and processes in the accounts payable workflow. With automation, invoices can be captured electronically, routed for approvals based on business rules, and released for payment without delays. This reduces the chances of errors, bottlenecks, or lost invoices, ensuring suppliers receive their payments in a timely manner.

How does workflow make your business more competitive?

Automation makes your business more competitive by enabling prompt and effortless payment to suppliers. When suppliers know they can rely on you for efficient payment, they are more likely to prioritize your business. This strengthens your supplier relationships and gives you a competitive advantage in terms of securing better deals or preferential treatment.

How does workflow help future-proof your business?

Automation helps future-proof your business by streamlining your accounts payable workflow. This reduces the reliance on manual processes, minimizing errors and inefficiencies. By automating repetitive tasks, you can allocate resources to more strategic activities, ensuring your business stays agile and adaptable to changing market conditions.

Workflow makes it easier to reconcile finances and access data for analysis and insights by eliminating manual tasks and providing real-time visibility into the accounts payable process. Automated systems can generate reports and analytics, allowing businesses to gain valuable insights, identify trends, make data-driven decisions, and streamline financial reconciliation processes.

How does automation improve security in the accounts payable process?

Automation improves security in the accounts payable process by reducing the risk of human error and potential fraudulent activities. Automated systems can implement robust security measures, such as encryption and access controls, to safeguard sensitive financial information and prevent unauthorized access.

What are the benefits of early payment discounts or virtual payment cashback rewards?

By streamlining the accounts payable workflow, businesses can take advantage of early payment discounts offered by suppliers. This enables them to save money by paying invoices promptly. Additionally, businesses may also benefit from virtual payment cashback rewards, further enhancing their financial gains.

Why can suppliers rely on businesses that have streamlined accounts payable workflows?

Suppliers can rely on businesses that have streamlined accounts payable workflows because automation ensures that invoices are processed efficiently and accurately. This reduces the likelihood of delays or errors in payment, providing suppliers with confidence in receiving their funds on time.

How does streamlining the accounts payable workflow using automation make a business more competitive?

Streamlining the accounts payable workflow using automation makes a business more competitive because it allows for prompt and effortless payment to suppliers. This reliability builds trust and confidence with suppliers, giving the business a competitive edge.

How does workflow improve security?

Automation improves security by reducing the risk of errors, fraud, and unauthorized access to sensitive financial information. Manual processes are more prone to human error and can be susceptible to fraudulent activities. Automation, on the other hand, ensures consistent and controlled processes, enforcing approval rules and maintaining compliance. This helps safeguard your financial transactions and protects against potential security breaches.

How does workflow enable you to reap the benefits of early payment discounts or virtual payment cashback rewards?

Automation enables you to reap the benefits of early payment discounts or virtual payment cashback rewards by accelerating the payment process. With automated workflows, invoices can be processed and approved quickly, allowing you to take advantage of early payment discounts offered by suppliers. Additionally, automation can facilitate virtual payment methods, such as credit cards, that offer cashback rewards, providing you with additional financial benefits.

How does workflow ensure prompt and effortless payment to suppliers?

Automation ensures prompt and effortless payment to suppliers by eliminating manual touchpoints and processes in the accounts payable workflow. With automation, invoices can be captured electronically, routed for approvals based on business rules, and released for payment without delays. This reduces the chances of errors, bottlenecks, or lost invoices, ensuring suppliers receive their payments in a timely manner.

How does workflow make your business more competitive?

Automation makes your business more competitive by enabling prompt and effortless payment to suppliers. When suppliers know they can rely on you for efficient payment, they are more likely to prioritize your business. This strengthens your supplier relationships and gives you a competitive advantage in terms of securing better deals or preferential treatment.

How does workflow help future-proof your business?

Automation helps future-proof your business by streamlining your accounts payable workflow. This reduces the reliance on manual processes, minimizing errors and inefficiencies. By automating repetitive tasks, you can allocate resources to more strategic activities, ensuring your business stays agile and adaptable to changing market conditions.

Vision360 Enterprise Accounts Payable Worlflow software integrates with many common ERP systems such as Oracle, SAP, MS Dynamics, QAD, BST, Lawson, JD Edwards, JDA, Paragon, Infinium, Infor BPCS, LX and many popular document management system like PaperVision Enterprise, ImageSilo and more.

Vision360 Enterprise brings accounts payable processing and business process automation to a whole new level.

Vision360 Enterprise brings accounts payable processing and business process automation to a whole new level.