|

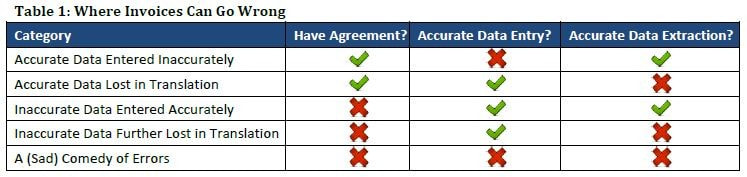

In Accounts Payable, exceptions are part of the game we play. The numbers will not always match up, and your invoices will not be 100% error-free. Some will arrive incorrect; others will become problematic when processed into your system. There are common error sources that you should be mindful of, and there are equally common ways of attempting to mitigate the problem. It’s important is to understand where problems can pop up, what options you have for identifying and fixing them, and how those choices can impact the efficiency and effectiveness with which you handle the invoice processing cycle. This article will walk you through this analysis, flagging some trouble spots for your review, and offering some advice on how to minimize their impact in your operations. What Causes Exceptions? Simply put, an exception is any situation where the numbers you receive do not match what you expect. Three key elements come into play here: (1) whether you and your supplier truly agree over the figures, (2) whether the information is accurately entered into the supplier’s system, and (3) whether any of those figures were incorrectly input due to manual data processing from the physical documents. The interaction of those different elements creates the four main sources of exceptions: accurate data that is entered inaccurately, accurate data that is lost in translation, inaccurate data that is nevertheless entered accurately, and inaccurate data that is made worse by faulty translation. Accurate Data Entered Inaccurately. There is agreement on what the items and numbers should be, but an error was made in transcription. This is a keying error, either when preparing the invoice by hand, when creating it in the source system, or when keying it into the buyer’s portal. These errors are purely attributable to mistakes in data entry. Accurate Data Lost in Translation. There is agreement on items and numbers, and those details are recorded accurately, but due to print/image quality, font choice, extraneous markings, etc., the information is inaccurately read by the recipient. This can come from the physical printer or from within the software used to translate documents and images to usable data. These errors stem from the use of technology to transform data to physical form – and then back again. Inaccurate Data Entered Accurately. There is a disagreement over items, numbers, or terms, but the supplier’s view is accurately entered on the invoice. The invoice may be prepared without referencing an existing contract, so that proper terms or discounts are not reflected. The invoice may not reflect an outstanding credit that was expected to be applied against the total due. Similarly, the buyer’s expectation could be erroneous, such as when their expectation of a lower price is based on volume discounts under an unknowingly expired contract. These types of errors stem from problems with integrating and tracking disparate sources of information. Inaccurate Data Further Lost in Translation. Take data that’s already “wrong” and further complicate the situation by inaccurate transmission. This looks much the same as the earlier categories, but can be more difficult when trying to identify the root cause. For example, if you’re charged $1.00 instead of $0.90, that 10% difference may be easily traced to the supplier failing to apply a negotiated discount called for in an existing contract. But if the price is mistakenly entered as $7.00 (due to a stray mark on the physical paper invoice), you now have two steps to work through: figuring out that the base price should have been $1.00 and that the purchase was governed by a contract which would bring the actual cost to $0.90. In this case, consulting the Purchase Order should provide clarity, but you might need to refer back to the contract as well to clear things up with your supplier’s Collections/Receivables representative. These errors are the result of from a combination of disagreement over the correct figures and technological problems when transforming a physical document into usable data. A (Sad) Comedy of Errors. You disagree about terms, quantities, or prices. That already-incorrect information is then mistyped in the source document. Finally, to complete the failure trifecta, some printing artifact adds another source of error by misreading the information in import. This unlikely series of events is caused by a lack of integration (disagreement), reliance on manual keying (data entry). What Impact Do These Errors Have? There are time and cost implications in dealing with exceptions. The degree to which they impact your operations derives from how you choose to deal with the problem. Generally, you have three choices: (1) you can choose not to investigate, (2) you can do enough to uncover the error and dispute it, or (3) you can fully research the situation to uncover the source of the problem. Not identifying errors. When problems slip through, you’re simply paying as invoiced, which is a bit of mixed bag. If an invoice was accurate then there’s no harm done. If it was inaccurate but the deviation was minor, then you’re probably fine (unless the volume of invoices processed means thousands of “slightly off” invoices add up to respectable amounts in aggregate). The real problem is that you don’t know – and that’s where fraud is a big risk. Were the invoices goods or services actually purchased? Were they delivered? Is this a valid vendor? If we assume that everything else has been functioning perfectly (which is generally not a good assumption to make) then both your cost and time impact is essentially zero. In all likelihood, your cost impact (or undiscovered over-payment) is greater than zero, while the extra time devoted to finding errors remains nil. Identifying errors. When problems are uncovered, there are two main performance-related questions to ask: how much time did it take to identify the problem, and how much time will be required to fix it? In the simplest case, you’d uncover a problem by comparing the invoice against one other document – either the original Purchase Order or the receiving document. That may show an incorrect price, or confirm that the incorrect number of an item was received. The difficulty of (or time required for) consulting those documents is based on how and where they are stored, and what the process is for retrieving them. Are copies of PO's stored in a filing cabinet, organized by vendor? Are they stored near AP or with Purchasing on another floor or in another building? Are receipt documents available at all for this purchase, and if so, where are they stored? By asking these questions, you mitigate your risk of over-payment (or fraudulent payment), but at the cost of labor hours that could be spent on other tasks. Determining root causes. If the numbers don’t quite match, most of the information you need is likely on the documents you had in-hand when identifying the error initially. However, you may also need access to supplier contracts, credit memos received, or debit memos sent (but not acknowledged by a return credit memo). As before, this leads to questions of where and how these documents are stored and how they can be retrieved. It also requires additional time to sift through the documents and track down the source of any discrepancies. This information will be both important and helpful when registering a dispute with your supplier’s accounts receivable department. If they are well-run, they follow different procedures for genuine disputes than for traditional collections, and your documentary proof will ensure that you’re placed in the correct queue. This category of investigation increases the amount of labor consumed, with the intent of uncovering underlying problems and preventing errors in the future. It may not make sense to undertake for every small purchase from an occasional supplier, but could very well be justified when dealing with high-volume and/or strategic suppliers, since the errors uncovered would likely be repeated in future transactions. Why Do These Errors Happen? As mentioned above, some “errors” are attributable to a disagreement between what you and your supplier believe to be correct. That said, there is also a lot of room in the invoice-creation, -receipt, and -processing cycle for more mundane (but equally important) problems to crop up. There are common error sources in those situations where you and your supplier are actually in agreement on the numbers, but the documents involved don’t match that shared understanding. What Can Be Done? There are some common patterns. When documents are stored on paper, they require physical storage – which may or may not be located within a convenient distance to AP. If it is within the same office, retrieval speed is dictated mainly by how quickly you can walk and by how well your storage is organized. In a larger building or campus environment, this speed is more dependent on request submission, processing, and interoffice mail delivery. For distributed environments (multi-office locations), request submission and retrieval are the same, with fax, scan-and-send, or even postal mail replacing the interoffice option. If you deal with any appreciable number of purchase orders and invoices, a digital storage approach can save a lot of time. If you have an organized and efficient way to store and retrieve electronic documents, then your best bet is to maximize the number that you receive from suppliers. Because hand-keyed documents are prone to data entry errors, you should request that system-generated invoices be sent electronically, even if that’s just via email. If you are able to import data into your system, data extraction services and solutions work very well, especially on documents that have been digital from the start rather than those that have been printed, mailed, and then scanned into an image that may introduce some artifacts. That said, their bread-and-butter is in the paper-to-digital conversion process, so the technology has ways of reducing the negative impact of those sorts of stray markings. As above, having documents in digital form can speed up retrieval and access time – and that can be a huge efficiency gain when the physical copies would be somewhere at the end of a request-and-mail process. Once you have that quick access, you’d still be doing a manual comparison by eye. That’s where automated PO matching can improve both efficiency and effectiveness in identifying errors. Again, if you receive only a small volume of relatively simple (i.e. one- or two-page) invoices, this may be overkill. As volumes and complexity increase, however, something has to give: you can either process quickly with the potential to miss something, or methodically in order to catch problems. Since matching is usually part of an invoice workflow package, it also offers help in areas beyond the current discussion. Conclusion When dealing with invoices, errors will occur. They may be due to disagreements, to data entry errors, or to some degree of technological confusion when converting between paper and digital formats. Ignoring the potential issue is not a satisfactory solution. Beyond that, the amount of time and money devoted to spotting errors and identifying root causes is a business decision to be made based on the size and setup of your organization, the potential costs of those errors, and the level of investment necessary to get things into shape. The best solution may simply be digitizing or receiving invoices electronically, extracting and validating invoice data, and leveraging AP Automation technologies that automatically route, GL code and 3-way match invoices while connecting to your ERP system to eliminate manual data entry. Regardless of the specific approach taken, it is necessary for all accounts payable departments to recognize the difficulties that inaccuracies and errors can introduce, and the availability of multiple options (both process- and technology-related) to help improve the situation. 2014 Reprint and slightly modified to fit the AP Processing Requirement and standards of 2021

Scott Pezza Director, Industry and Value Advisory for Spend Management

0 Comments

|

AuthorVision360 Enterprise Accounts Payable Automation Solution by BlueCreek Software reduces time wasted chasing down paper invoices by automating invoice approvals, eliminating manual data entry, eliminating paper invoices and reducing processing costs. Categories

All

Archives

September 2023

|

RSS Feed

RSS Feed