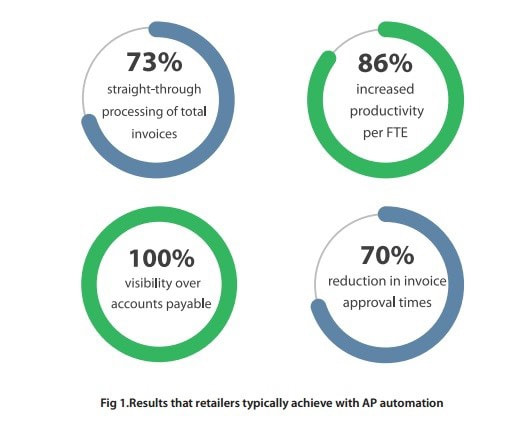

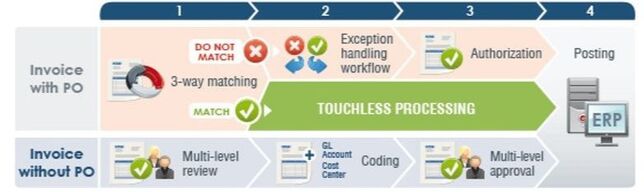

Executive SummaryManufacturing organizations face different challenges to their counterparts in other sectors. The highly-competitive nature of the industry creates pressure to adopt a lean approach to delivering goods and services to customers. This has led to an increasing emphasis on customer centricity and faster, more robust supply chains. While there tends to be a focus on front-end process improvements, manufacturers realize that there is also a need to extend these improvements to their back-end processes, particularly in accounts payable (AP) and procurement. AP refers to the entire process by which organizations pay for goods and services, from the receipt of the goods to the processing and payment of the vendor invoice. In an effort to reduce costs and optimize efficiency, leading organizations are implementing AP automation software and streamlining their back office functions. This article serves as a guide for finance leaders on the drivers for implementing AP automation and the value it adds to the manufacturing supply chain. It summarizes the issues that manufacturers are faced with, and the benefits that AP automation has delivered to a range of organizations, including, reduced costs, increased visibility, improved efficiency in AP processes, and enhanced vendor management. The paper highlights the ways in which AP automation can be integrated with existing ERP, procurement, and supply chain systems, and ensure tangible results including: IntroductionOrganizations in the manufacturing sector have a faster supply chain, and there are greater demands to purchase and deliver goods and services quicker and in innovative ways. As businesses increasingly focus on meeting the needs of the customer in order to outperform competitors, many manufacturers offer goods via multiple channels putting pressure on companies to improve processes in the front and back ends of the business. The use of e-commerce, in particular, and the demand for ever shorter delivery times has forced manufacturers to shift focus from traditional brick-and-mortar to online ordering. For this tilt to be possible, supply chains must be fast and reliable, and back end processes must be agile and automated. This pressure to improve back end processes to achieve cost reduction and maximum profitability is widely covered in industry research. Forrester research predicts that customer centricity, analytics, and optimization will be key for manufacturers in order to distinguish themselves from competitors and mitigate the risk of reduced growth. Research confirms that management will fundamentally change the pace of their business, replacing cumbersome, manual processes with automated, agile ones. According to further research, this is a key area of focus for the future: 81% of executives surveyed agreed that operational efficiencies are a priority to improve profitability. Organizations can gain a competitive edge in the manufacturing sector by allowing finance teams to focus on their core activities. AP automation eliminates the manual tasks of invoice data entry, coding, approval, matching, and payment, allowing operations and finance teams to focus on strategic, high-value work. A dedicated system for auto-mating AP tasks ensures that costs are significantly reduced and spend management is brought under complete control. AP automation can have considerable impact on the bottom line, delivering cost savings as a result of increased transparency over company spend, improved efficiency, reduced costs, and better relationships with vendors. AP Challenges in Manufacturing Manufacturing organizations typically utilize industry-specific systems for procurement, particularly for purchasing goods, as this accounts for approximately 80% of total spend and is vital for revenue growth. However, when it comes to goods, including expense items such as marketing, legal fees, utilities, etc., organizations generally do not employ a dedicated system for procurement and AP, and instead rely heavily on manual processes. This results in deficient spend management, a lack of transparency, and poor vendor management, which contributes to inefficient AP pro-cesses. AP automation replaces these inefficient processes with structured solutions that enable finance leaders to take control of company spend, increase productivity of their teams, and improve vendor relations. 1. Manufacturing Specific ComplexitiesThe manufacturing industry has many industry-specific challenges in purchasing goods and services such as tolerances (allowing an organization to manage under shipments, late shipments, and unit price variations that cause discrepancies between the PO, invoice, and goods receipt), surcharges (for returns or for over handling of goods), and over-receipting (receiving more goods than originally ordered), and individual organizations have additional, bespoke business requirements to meet. AP automation solutions facilitate all these manufacturer-specific requirements as well as the standard AP requirements such as duplicate invoice checking, varied payment terms, discount allocations, and VAT calculations. In a manual AP environment. This results in disjointed back-end processes, with a primary focus on goods, and crucially, without one single view over finance operations. 2. Different Processes for Different Types of InvoicesIn typical manufacturing environments, the different types of invoices are often separated with either by different systems, or by different AP teams. This separation of processes for PO vs Non-PO spend results in unnecessary complexity, duplication of resources and a lack of visibility of overall spend. Invoices for goods are typically received in e-mail, EDI, or XML for-mats, while non-trade invoices are received in e-mail, paper, or PDF formats. Procurement of trade goods is typically man-aged by industry-specific solutions and while these systems may automate the creation and approval of purchase orders (PO), organizations ultimately rely on manual processes to complete the remaining AP steps including invoice capture, matching, and posting for payment. 3. Lack of Visibility & Control Over Expense SpendOn the expense side, manufacturing organizations typically do not utilize systems specifically for expense invoices or the associated Non-PO AP tasks, in which case the AP teams are left to manually complete every step from procurement through to payment of invoices. This manual processing is inefficient, slow, and uncontrolled, with a high number of touch-points which drives up the costs involved in processing an invoice, and increases the risk of human error. This makes it difficult to manage expense spend, which is often non-PO based and can often account for over 20% of total spend. Typical problems that arise with non-trade spend are retrospective approvals, maverick buying, and non-adherence to company spend policies. 4. Duplicate InvoicesIn manufacturing environments, it is common for organizations to have large numbers of vendors across global locations. This poses several complex challenges which often are not sufficiently managed by existing ERPs and, as a result, organizations implement further manual processes to handle them. One challenge faced by many manufacturers is duplicate invoices and duplicate payments. In AP departments with no automation, manual processing naturally results in human inefficiencies and inconsistent invoice handling processes. From a vendor point of view, there is no visibility over whether or not an invoice has been received, approved, or paid, which often leads to vendors submitting invoices multiple times (by post, EDI or email) in an effort to get paid more quickly. Since there are no reliable ways to detect duplicate invoices in a manual environment, AP teams end up duplicating their effort to process these invoices and in some cases ultimately making duplicate payments which result in commercial implications and require further effort to remedy. 5. Vendor ManagementVendor management is another area where manufacturing organizations often find they struggle. This is due to limitations in the ERP vendor master data and the lack of structured tools within the ERP to efficiently and accurately manage existing vendors and on-board new vendors. Simple requirements, such as ensuring that all vendors are compliant with tax clearances, industry certifications, insurances, and other buyer-specific policies, are typically managed externally from the ERP using offline, manual processes. Likewise, vendor contract renewals and other vendor updates are often handled in a similar manual fashion. 6. Remote WorkforceIn today's world the need has never been great for staff, teams and employees to have remote access to business decision making information and accounts payable is no exception. Since the COVID outbreak in March of 2020 teams of people have been forced to work remotely and or from home. With limited access to information, invoices and documents necessary to keep the supply chain moving, many manufacturers feel sluggishly behind. Those manufacturers who were already prepared by implementing applications that provided the immediate secure transfer of knowledge outside their four walls were able to continue operating with little to no interuption. Interested in learning more? The AP Automation Solution for ManufacturingThe AP automation solution allows organizations to control buying from approved vendors and management can enforce strict ‘No PO, No Pay’ policies and gain full visibility over what is being purchased. AP automation solutions work seamlessly with multiple ERP systems and provide a single view of the world for AP teams. Segregated AP teams can be consolidated and the manual paper-based processes and spreadsheets are replaced with structured and controlled systems. This allows the entire AP process to be automated by one solution, eliminating the need for two separate AP processes, and two separate AP teams. The automated processing of invoices enables finance teams to only handle invoices by exception and to prioritize by key criteria such as value, early payment discounts, aging, etc. Re-porting and analytics also provide finance leaders with the necessary dashboards to project operational and financial metrics such as processing times, FTE productivity, approver performance, invoice accruals and vendor performance. Other industry-specific challenges can also be managed. In manufacturing it is not unusual for vendors to send invoices be-fore the goods arrive - often as soon as the goods are ordered - in an effort to expedite the receipt of payment. Situations like this can cause real problems with traditional manual processes. However, with AP automation, invoices are automatically assigned an expected arrival date and are held pending the goods receipt note (GRN). When the GRN is received, the system triggers an automatic 2- or 3-way match, and unless an exception is found it will be automatically approved and routed for payment. AP automation provides a single system for processing all invoices through a structured workflow with automated matching and built-in approval logic. This ultimately enables the touchless processing of invoices and focuses AP teams on only handling invoices with exceptions. Vision360 Enterprise AP Automation Invoices can be captured in any format including paper, XML, PDF and EDI, so manufacturers can accept invoices electronically from sophisticated vendors using XML/EDI or, for other vendors, they can also automate the processing of invoices received by paper, email or PDF or submitted electronically. Vendors receive notifications regarding the status of submitted invoices, providing them with visibility over whether invoices have been received, processed, approved or paid. AP automation allows for better control over the organization’s cash flow. It equips the AP team with transparency over all vendors, enabling them to consider early payment discounts, and to strategically buy from preferred vendors and schedule payments in order to avail of these discounts. The solution also facilitates multiple languages and currencies, and provides full visibility over pending payments, allowing management to make informed decisions on when to pay invoices without incurring unnecessary charges. Taxes and freights, which are not always accurately accounted for in a manual environment, is fully automated within the AP solution, enabling precise payment and reporting. The Cost Benefit of AP AutomationThe costs incurred in the finance department can be significant. Automating the AP process enables organizations to achieve better employee productivity, increased visibility and control over spend (both trade and non-trade), and significant cost savings at each stage in the AP process. Industry research by PayStream has found that 90% of CFOs that implemented AP automation achieved an average savings of 80% in invoice processing costs. The cost of manually processing invoices can be significant. Forrester reports that over 97% of invoices are processed manually. The average cost of processing invoices varies, but can amount from $15 up to $45 per invoice.

How Does AP Automation Work?AP refers to the entire process by which organizations pay for goods and services, from the receipt of the goods to the processing and payment of the vendor invoice. Successful organizations are modernizing their AP processes by automating each of the steps involved. AP automation can be achieved by transforming the following tasks:

Learn more about AP Automation and see it live! ConclusionCompetition between manufacturers has resulted in greater demands to establish differentiation. In order to get ahead, manufacturers are making efforts to provide improved goods and services to consumers. Considering the emphasis on speedy supply chains and the importance of vendor relationships for success in manufacturing, companies have started to improve back end processes in order to increase efficiency and maximize profitability. Leading organizations have deployed AP automation in order to deliver considerable efficiencies and have achieved faster invoice processing times, reduced in-voice processing costs, improved vendor relationships, and lower overheads and labor costs. Automation of AP processes allows for better visibility and control over total spend (both trade and non-trade) which enables finance teams to produce higher value reporting and analysis of operations. About UsBlueCreek Software is a leading provider of financial process automation and developer of Vision360 Enterprise software, replacing inefficient processes with solutions that transform financial processes, reduce costs, and ensure that organizations meet their business and compliance obligations. Do you have questions or want to learn more?

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorVision360 Enterprise Accounts Payable Automation Solution by BlueCreek Software reduces time wasted chasing down paper invoices by automating invoice approvals, eliminating manual data entry, eliminating paper invoices and reducing processing costs. Categories

All

Archives

September 2023

|

RSS Feed

RSS Feed