The NEW Accounts Payable Department Being Shaped by the Changing World.

If there were any lingering doubts about the necessity of digital transformation to business longevity, the coronavirus has silenced them. In a contactless world, the vast majority of interactions with customers, suppliers and employees must take place virtually. With rare exception, operating digitally is the only way to stay in business through mandated shutdowns and restricted activity. It’s go digital, or go dark.

This digital mandate isn’t new; it’s simply been brought into sharp focus. Prior to the pandemic, a paradigm shift towards digitization and servitization was already underway. Current events have accelerated the paradigm, as evidenced by the marked shift in spending towards digital businesses.

The pandemic is a reality check for businesses that have been reluctant to embrace digital transformation and now find themselves woefully unprepared. On top of the stress of potentially health-compromised employees, a sudden and dramatic drop-off in demand and total economic uncertainty, these digital laggards are now scrambling to migrate their operations and workforce to a virtual environment. While fast and furious is the name of the game when it comes to digital innovation, fast and frantic can lead to mistakes.

This digital mandate isn’t new; it’s simply been brought into sharp focus. Prior to the pandemic, a paradigm shift towards digitization and servitization was already underway. Current events have accelerated the paradigm, as evidenced by the marked shift in spending towards digital businesses.

The pandemic is a reality check for businesses that have been reluctant to embrace digital transformation and now find themselves woefully unprepared. On top of the stress of potentially health-compromised employees, a sudden and dramatic drop-off in demand and total economic uncertainty, these digital laggards are now scrambling to migrate their operations and workforce to a virtual environment. While fast and furious is the name of the game when it comes to digital innovation, fast and frantic can lead to mistakes.

New Reliance on Digital Solutions

Digitization has stepped in to bridge the gaps left by mandated shutdowns and social distancing measures. Without digital tools and technologies, we would have no way to work, shop, go to school, and more.

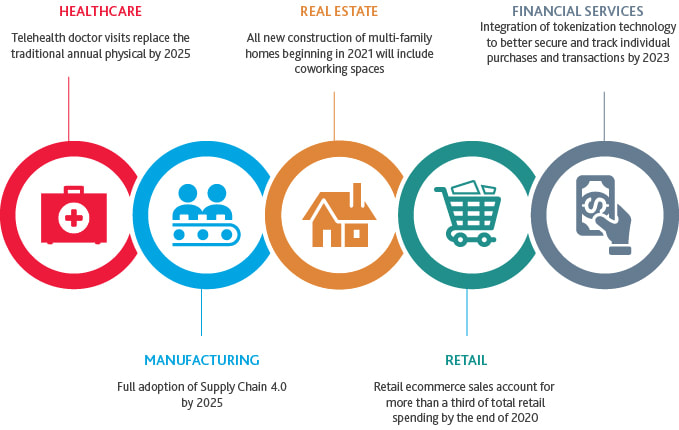

Let’s take a closer look at how digitization is keeping society–and businesses–afloat during the pandemic

Let’s take a closer look at how digitization is keeping society–and businesses–afloat during the pandemic

- Remote Work: Before the pandemic, only 30% of U.S. employees worked remotely 100% of the time, according to Owl Labs. For the other 70%--including the 38% of the total U.S. workforce that only worked on-site—the transition to working remote full-time has been a shock to the system—figuratively, and in some cases, quite literally, when user demand has exceeded system bandwidth. But the silver lining is that with such a high percentage of the working population now remote, digital collaboration is improving in leaps and bounds, both in terms of the sophistication of the tools to facilitate it and workers’ level of comfort with it.

- Digital Content Consumption: Homebound consumers are turning to digital content providers to meet their entertainment needs. 51% of internet users worldwide are watching more shows on streaming services due to the coronavirus, according to data from Statista. Netflix alone saw 16 million new signups for its service in the first three months of 2020. Meanwhile, many film studios have been pushing new releases to streaming services early to captive audiences.

- Platformification: Institutions and organizations of all types are trying out digital platforms to stay above water during the pandemic. The fitness industry has shifted to holding virtual classes on streaming services, both live and pre-recorded. Almost every school, from elementary schools through graduate programs, have shifted to online courses. Large-scale conferences and events are being held virtually. The NYSE has moved entirely to online trading. While some businesses will revert to their traditional models when the crisis abates, others may opt for a hybrid approach as they recognize the benefits of recurring revenues.

- Digital Health Solutions: Much of America’s healthcare system has gone digital to alleviate some of the strain imposed by the coronavirus. Telemedicine and remote diagnostics are helping patients get medical advice and diagnoses at home so they don’t need to come in to the doctor’s office or hospital, and 3D printing is being used to expedite the production of critical medical supplies, such as PPE. In the absence of a vaccine or proven treatment, the best preventative medicine is information-sharing. Digital contact tracing has already been used to effectively slow the spread of COVID-19 in East Asia. The technology itself is at least a decade old but has struggled to gain traction in the Western world where views on privacy have been prohibitive. Whether American citizens (and those that govern them) will be willing to trade individual privacy rights for the greater public good remains to be seen, but there may be more leniency around data collection going forward.

Get a copy of our eguide The Complete Guide to Accounts Payable Automation services.