AP AUTOMATION: What does it all Mean?

|

AP Automation refers to the use of technology and software solutions to streamline and automate the processes involved in managing an organization's accounts payable function. The primary focus of AP Automation is to enhance the efficiency, accuracy, and control of tasks related to the processing and payment of invoices, thereby optimizing the entire accounts payable workflow.

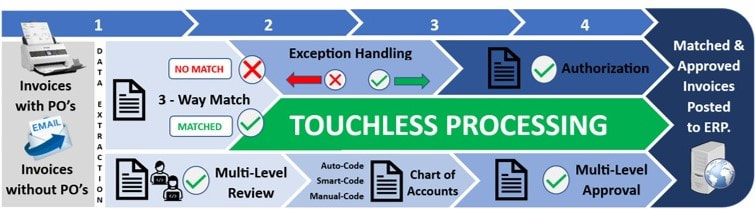

Key components of AP Automation typically include the digitization of documents, such as invoices, the use of technologies like AI and Optical Character Recognition (OCR) for data extraction, automated validation and approval workflows, purchase order matching integration with other financial systems (such as Enterprise Resource Planning or ERP systems), and electronic payment processing. By leveraging AP Automation, businesses can reduce manual intervention, minimize errors associated with data entry, expedite invoice approval cycles, enhance visibility into financial processes, and ultimately achieve cost savings and operational efficiency. The automation of accounts payable processes contributes to a more streamlined and accurate financial management system, allowing organizations to allocate resources more strategically and make informed decisions based on real-time data insights. |

|

10 Steps to AP Automation: The Lifecycle of an Accounts Payable Invoice

|

1. Document Capture: The AP Automation process begins with AP invoice scanning and document capture, where invoices are scanned or digitally imported into the system. This step marks the transition from paper-based to electronic document management, reducing the risk of data entry errors associated with manual input.

2. Data Extraction using AI & OCR Capture: AI and Optical Character Recognition (OCR) technology is employed to extract relevant information from invoices automatically. This includes details such as invoice number, date, vendor information, and line-item details. OCR significantly accelerates the data entry process and enhances accuracy.

3. Invoice Validation and Approval Workflow: The invoice approval workflow system validates extracted data against predefined rules and policies to ensure accuracy. Subsequently, invoices are routed through an automated approval workflow. Approvers receive notifications and can review, edit, or approve invoices based on their designated roles and permissions.

4. Integration with ERP Systems: AP Automation seamlessly integrates with Enterprise Resource Planning (ERP) accounting systems, syncing validated data and approved invoices. This integration ensures a unified financial ecosystem, minimizing data silos and providing a holistic view of financial transactions.

5. Three-Way Matching: To further enhance accuracy, AP Automation employs three-way PO invoice matching, comparing the purchase order, invoice, and receiving report. Any discrepancies are flagged for review, preventing erroneous payments and promoting adherence to procurement processes.

|

6. Automated Payment Processing: Once invoices pass through the approval and matching stages, the system initiates the supplier payment process. AP Automation supports various payment methods, including electronic funds transfer (EFT), checks, and virtual cards, providing flexibility based on vendor preferences.

7. Exception Handling and Resolution: In cases where exceptions or discrepancies arise, AP Automation facilitates streamlined resolution processes. Appropriate stakeholders are alerted, and the system provides tools for quick resolution, preventing delays in the payment cycle.

8. Reporting and Analytics: AP Automation platforms offer robust reporting and analytics capabilities. Users can generate custom reports to analyze spending patterns, identify potential cost-saving opportunities, and gain insights into the overall financial health of the organization.

9. Archiving and Compliance: All processed invoices and related documents are securely archived in compliance with regulatory requirements. AP Automation ensures that organizations maintain a comprehensive and easily accessible record of their financial transactions for auditing purposes.

10. Continuous Improvement and Optimization: AP Automation systems support continuous improvement initiatives by providing data-driven insights into process efficiency. Organizations can analyze performance metrics, identify bottlenecks, and implement optimization strategies to further enhance the AP workflow over time. Regular assessments ensure that the AP Automation system evolves with the changing needs of the business, maintaining peak efficiency.

|

Who trusts Vision360 for AP Automation Yankee Candle, Wachusett Healthcare, Welchs & Many More

10 Reasons to Implement AP Automation

In the ever-evolving landscape of business operations, staying ahead requires embracing technological advancements that enhance efficiency and accuracy. One such game-changer is Accounts Payable (AP) Automation, a transformative solution that revolutionizes financial processes. From small businesses to large enterprises, the uses and benefits of AP Automation are proving to be indispensable.

1. Streamlined Invoice Processing: One of the primary use cases of AP Automation is the streamlined processing of invoices. Traditional manual methods are time-consuming and error-prone, leading to delays and potential discrepancies. With AP Automation, the entire invoice lifecycle is automated, from data capture to approval, resulting in faster, more accurate transactions.

2. Accelerated Approval Workflows: AP Automation eliminates bottlenecks in the approval process. Automated workflows ensure that invoices are routed to the right stakeholders promptly. Approvers receive notifications, enabling them to review and approve invoices swiftly, thereby reducing the time it takes to move from approval to payment.

3. Error Reduction and Accuracy: Manual data entry is inherently susceptible to errors, which can have cascading effects on financial records. AP Automation utilizes advanced technologies like Optical Character Recognition (OCR) to extract and validate data, minimizing errors and ensuring the accuracy of financial information.

4. Enhanced Visibility and Control: AP Automation provides unparalleled visibility into the financial processes of an organization. From the moment an invoice is received to its final payment, stakeholders can monitor and control each step. This transparency not only ensures compliance but also enables strategic decision-making based on real-time data.

5. Cost Savings and Efficiency: Efficiency and cost savings go hand in hand with AP Automation. By automating repetitive tasks, businesses can significantly reduce operational costs. The time saved by employees can be redirected towards more strategic activities, contributing to overall productivity and financial health.

6. Improved Vendor Relationships: AP Automation fosters positive relationships with vendors. Timely and accurate payments, coupled with automated notifications, enhance communication and trust. Vendors appreciate the efficiency of automated systems, leading to stronger and more collaborative partnerships.

7. Compliance and Security: AP Automation ensures compliance with regulatory requirements by securely archiving documents and maintaining detailed audit trails. Advanced security features, such as encryption and multi-level authentication, protect sensitive financial information, reducing the risk of fraud and unauthorized access.

8. Scalability for Business Growth: The scalability of AP Automation makes it an ideal solution for businesses of all sizes. Whether a startup or an enterprise, the system can adapt to growing transaction volumes, ensuring continued efficiency and effectiveness as the business expands.

9. Strategic Decision-Making with Analytics: AP Automation goes beyond transactional efficiency; it empowers organizations with data-driven insights. Analytics and reporting tools provide valuable information on spending patterns, vendor performance, and areas for optimization, facilitating informed and strategic decision-making.

10. Employee Empowerment and Satisfaction: By automating repetitive and time-consuming tasks, AP Automation empowers employees to focus on more meaningful and strategic activities. This not only enhances job satisfaction but also contributes to a more skilled and engaged workforce.

1. Streamlined Invoice Processing: One of the primary use cases of AP Automation is the streamlined processing of invoices. Traditional manual methods are time-consuming and error-prone, leading to delays and potential discrepancies. With AP Automation, the entire invoice lifecycle is automated, from data capture to approval, resulting in faster, more accurate transactions.

2. Accelerated Approval Workflows: AP Automation eliminates bottlenecks in the approval process. Automated workflows ensure that invoices are routed to the right stakeholders promptly. Approvers receive notifications, enabling them to review and approve invoices swiftly, thereby reducing the time it takes to move from approval to payment.

3. Error Reduction and Accuracy: Manual data entry is inherently susceptible to errors, which can have cascading effects on financial records. AP Automation utilizes advanced technologies like Optical Character Recognition (OCR) to extract and validate data, minimizing errors and ensuring the accuracy of financial information.

4. Enhanced Visibility and Control: AP Automation provides unparalleled visibility into the financial processes of an organization. From the moment an invoice is received to its final payment, stakeholders can monitor and control each step. This transparency not only ensures compliance but also enables strategic decision-making based on real-time data.

5. Cost Savings and Efficiency: Efficiency and cost savings go hand in hand with AP Automation. By automating repetitive tasks, businesses can significantly reduce operational costs. The time saved by employees can be redirected towards more strategic activities, contributing to overall productivity and financial health.

6. Improved Vendor Relationships: AP Automation fosters positive relationships with vendors. Timely and accurate payments, coupled with automated notifications, enhance communication and trust. Vendors appreciate the efficiency of automated systems, leading to stronger and more collaborative partnerships.

7. Compliance and Security: AP Automation ensures compliance with regulatory requirements by securely archiving documents and maintaining detailed audit trails. Advanced security features, such as encryption and multi-level authentication, protect sensitive financial information, reducing the risk of fraud and unauthorized access.

8. Scalability for Business Growth: The scalability of AP Automation makes it an ideal solution for businesses of all sizes. Whether a startup or an enterprise, the system can adapt to growing transaction volumes, ensuring continued efficiency and effectiveness as the business expands.

9. Strategic Decision-Making with Analytics: AP Automation goes beyond transactional efficiency; it empowers organizations with data-driven insights. Analytics and reporting tools provide valuable information on spending patterns, vendor performance, and areas for optimization, facilitating informed and strategic decision-making.

10. Employee Empowerment and Satisfaction: By automating repetitive and time-consuming tasks, AP Automation empowers employees to focus on more meaningful and strategic activities. This not only enhances job satisfaction but also contributes to a more skilled and engaged workforce.

9 Additional Benefits of AP Automation

|

1. Increased Efficiency in Invoice Processing: AP Automation streamlines the invoice processing workflow by automating data entry and validation. This results in a significant reduction in processing time, allowing organizations to handle a higher volume of invoices with greater efficiency.

2. Error Reduction and Improved Accuracy: AP Automation minimizes the risk of human error associated with manual data entry. By utilizing OCR technology to extract information and implementing validation rules, the system ensures accuracy in financial data, reducing the likelihood of costly mistakes.

3. Accelerated Approval Cycles: With automated approval workflows, AP Automation speeds up the invoice approval process. Approvers receive notifications promptly, and the system facilitates quick reviews, leading to faster decision-making and a shortened payment cycle.

|

4. Enhanced Visibility into Financial Processes: AP Automation provides real-time visibility into the status of invoices and payments. Stakeholders can track the progress of transactions, monitor approval stages, and gain insights into overall financial health, fostering better decision-making.

5. Fraud Prevention and Security: Automated systems offer advanced security features, such as multi-level authentication and audit trails, to prevent fraudulent activities. This ensures that financial transactions are secure and protected from unauthorized access.

6. Improved Vendor Relationships: AP Automation contributes to positive vendor relationships by ensuring timely and accurate payments. Automated notifications keep vendors informed about payment status, reducing inquiries and fostering a collaborative and trusting partnership.

|

7. Strategic Financial Decision-Making: The analytics and reporting capabilities of AP Automation empower organizations to make informed financial decisions. Insights into spending patterns, vendor performance, and potential cost-saving opportunities contribute to strategic financial planning.

8. Scalability for Business Growth: AP Automation is scalable, accommodating the increasing volume of financial transactions as businesses grow. Whether a company is a small startup or a large enterprise, the system can adapt to evolving needs, supporting scalability without sacrificing efficiency.

9. Cost Savings & Resource Reallocation: By automating repetitive tasks, AP Automation allows organizations to achieve significant cost savings. Employees can redirect their efforts from manual data entry to more strategic activities, contributing to overall operational efficiency and resource optimization.

|