20 Ways to Streamline Accounts Payable to be More Efficient!

Here are 20 ways to streamline the accounts payable process to create a more efficient process!

- Clear Submission Guidelines:

- Provide suppliers with detailed guidelines specifying the preferred format, required documentation, and any specific instructions for submitting invoices.

- Standardized Invoice Templates:

- Encourage suppliers to use standardized invoice templates that include all necessary information, making it easier for your accounts payable team to process invoices accurately.

- Online Submission Portal:

- Implement a secure online portal where suppliers can submit their invoices. This not only ensures data security but also facilitates a more efficient and organized intake process.

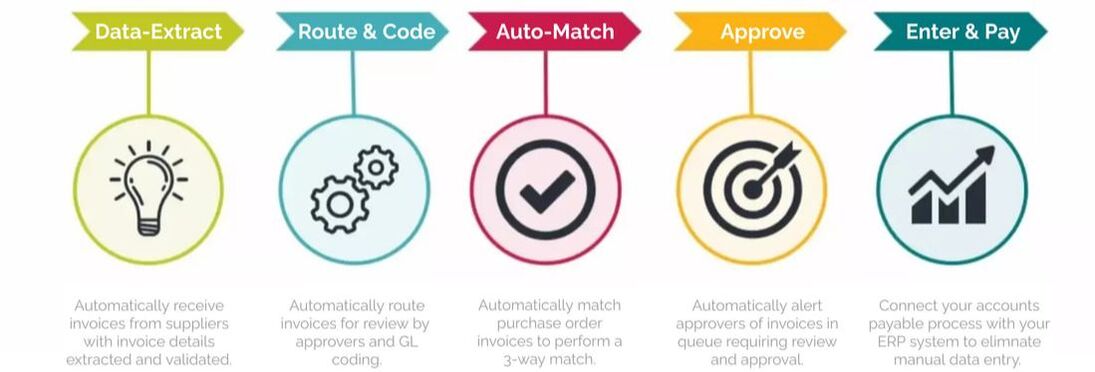

- Electronic Invoicing:

- Promote electronic invoicing to reduce reliance on paper-based processes. Electronic formats speed up data entry and minimize the risk of errors.

- Automated Validation Checks:

- Utilize automated tools to validate incoming invoices. This includes checks for accuracy, completeness, and adherence to submission guidelines, helping to catch errors early in the process.

- Dedicated Email Address:

- Designate a specific email address for invoice submissions to streamline communication and ensure that all invoices are directed to the right department promptly.

- Early Submission Incentives:

- Offer incentives, such as early payment discounts, for suppliers who submit invoices ahead of schedule. This encourages a smoother cash flow and timely processing.

- Prompt Confirmation of Receipt:

- Send prompt acknowledgment of receipt for submitted invoices. This not only reassures suppliers but also helps in reducing follow-up inquiries, improving overall efficiency.

- Efficient Invoice Routing:

- Establish a well-defined and efficient approval workflow for invoices. This includes clearly defining roles and responsibilities to expedite the approval process.

- Transparent Approval Hierarchy:

- Clearly communicate the approval hierarchy to suppliers. This helps in avoiding delays by ensuring that invoices are routed to the appropriate individuals for approval.

- Regular Audits and Reconciliation:

- Conduct regular audits of accounts payable transactions to identify and rectify errors. Regular reconciliation ensures accuracy and compliance with financial regulations.

- Centralized Document Management:

- Implement a centralized document management system for invoices, receipts, and related documentation. This helps in quick retrieval and prevents delays caused by misplaced or lost documents.

- Effective Communication with Vendors:

- Maintain open and proactive communication with vendors. This includes providing updates on the status of their invoices and addressing any concerns promptly.

- Consistent Payment Terms:

- Negotiate and adhere to consistent payment terms with suppliers. This minimizes confusion and fosters a positive relationship by providing clarity in financial transactions.

- Cross-Functional Collaboration:

- Encourage collaboration between accounts payable and other departments, particularly procurement. This ensures a unified approach to addressing issues and streamlining processes.

- Regular Performance Reviews:

- Establish key performance indicators (KPIs) to monitor the efficiency of the accounts payable process. Regular reviews help identify areas for improvement and maintain a high standard of performance.

- Streamlined Payment Scheduling:

- Plan payment schedules strategically to optimize cash flow. This involves aligning payment dates with the organization's financial goals while adhering to agreed-upon vendor terms.

- Automated Reminders:

- Implement automated reminder systems for pending approvals or upcoming payment deadlines. This reduces the risk of oversights and ensures timely action on outstanding tasks.

- Continuous Employee Training:

- Provide ongoing training to accounts payable staff. This includes keeping them updated on industry trends, technological advancements, and best practices to enhance their skills and efficiency.

- Feedback Mechanism:

- Establish a structured feedback mechanism with suppliers to gather input on the invoicing process. Act on this feedback to make continuous improvements, fostering a collaborative and mutually beneficial relationship.